Your parent company is ready for global expansion, viewing the UAE as the key strategic gateway due to its robust economy and tax-efficient policies.

As a corporate decision-maker, you need an expert roadmap to enter this lucrative market while guaranteeing limited liability protection and 100% full ownership. The definitive solution is setting up a subsidiary company in the UAE.

This process is about extending your corporate legacy—not complexity. This guide will walk you step by step on how to set up a subsidiary company in UAE, covering everything from strategy and legal compliance to obtaining your business license. Avoid common pitfalls and start your UAE operations confidently.

2025 has brought major improvements in the UAE visa process for Pakistanis, making it faster, smoother, and more applicant-friendly. Whether you’re planning to work, visit family, start a business, or simply explore Dubai, the UAE continues to remain one of the top destinations for Pakistani citizens.

Let’s break down what’s really happening — and how you can apply for your UAE visa without stress.

What exactly is a Subsidiary Company in the UAE?

Before executing your expansion strategy, clarity on the legal structure is paramount.

A subsidiary company in UAE is a distinct legal entity that is either majority-owned or

wholly-owned (often 100% foreign-owned) by your existing parent company. It is established as a local business under UAE law, typically as a Limited Liability Company (LLC), while the parent retains controlling influence and shares.

Think of it this way: your subsidiary is legally independent, ensuring your corporate legacy is

extended without exposing the core parent company to unnecessary risk.

For businesses seeking a long-term, independent presence and essential liability protection, the subsidiary structure is the definitive, risk-mitigated expansion strategy in theUAE

Types of Subsidiary Company in UAE

When you ask how to set up a Subsidiary Company in UAE, you are fundamentally asking: What legal form will my entity take? The choice of Legal Structure is dictated by the jurisdiction you select and determines the operational scope and liability of your new UAE business subsidiary.

The most popular and relevant types for foreign subsidiaries fall into three main categories:

Type 1: Limited Liability Company (LLC)

This is the most common and flexible structure used for company formation in the UAE for foreign subsidiaries.

Type 2: Joint Stock Companies (Less Common for Subsidiaries)

These structures are typically reserved for large-scale operations or specific financial activities.

- Public Joint Stock Company (PJSC): Requires a substantial minimum Share Capital (e.g., AED 10 million) and involves listing shares for public trading. Not a typical choice for simply expanding operations.

- Private Joint Stock Company (PRJSC): Suitable for large private enterprises, with share capital typically around AED 2 million. Offers greater flexibility than a PJSC but still involves complex governance.

Type 3: Civil Company (For Professional Subsidiaries)

Civil Company: This is the structure primarily used for subsidiaries operating in professional services (e.g., legal consultation, auditing, engineering).

Key Requirement: While it allows 100% Foreign Ownership for professional activities, a Mainland Civil Company requires the appointment of a Local Service Agent (LSA) to liaise with the Government Ministries. The LSA has no stake in the company’s equity or management.

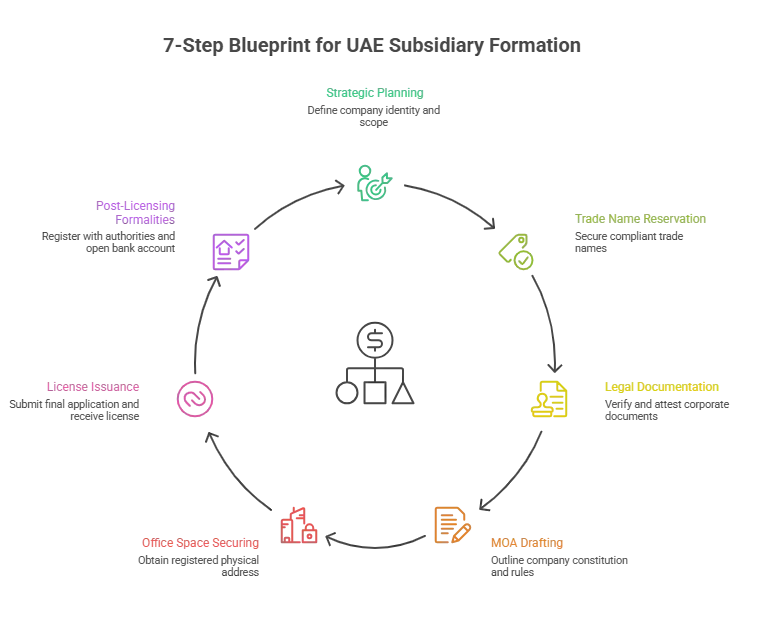

How to Set Up a Subsidiary Company in UAE: A 7-Step Blueprint

Navigating the process to establish a subsidiary in Dubai or anywhere in the UAE requires precision and adherence to specific local laws. This proven, step-by-step blueprint details the journey to company formation in the UAE.

The 7-Step Blueprint for Setting up a Subsidiary Company in UAE

Step 1: Strategic Planning & Jurisdiction Selection (The Foundation)

This initial phase defines your company’s identity and operational scope.

Business Activities: Clearly choose the business activities. This determines your Trade License type (Commercial, Professional, or Industrial).

Jurisdiction: Confirm your right jurisdiction (Mainland or specific Free Zone like DMCC, DIFC, etc.) based on your market access needs.

Share Capital: Determine the stated Share Capital for the subsidiary. While often not paid upfront, it must be included in the Memorandum of Association (MOA).

Step 2: Trade Name Reservation & Initial Approval

This is where the official process begins with the relevant authority.

Trade Name: Reserve your potential Trade names, ensuring compliance with UAE Naming Conventions (no offensive or non-secular references; must accurately reflect the business).

Initial Approval: Submit an application to the Department of Economy and Tourism (DET) for Mainland, or the Free Zone Authority. This pre-approval confirms there’s no objection to you forming the UAE business subsidiary.

Step 3: Legal Documentation & Attestation (The Paperwork Challenge)

This is the most time-consuming step involving the parent company’s verification. All corporate documents from the home country must be verified for use in the UAE.

Required Documents: Typically includes the Certificate of Incorporation, Memorandum & Articles of Association (MOA & AOA), Board Resolution (to establish the subsidiary, appoint the manager, and grant Power of Attorney), and Certificate of Good Standing.

Attestation Process: This multi-stage process is critical:

Notarization in the home country.

Attestation by the UAE Embassy in the home country.

Final Attestation by the UAE Ministry of Foreign Affairs (MOFA).

Pro Tip: Document attestation is the prime source of delays. Using an expert with a robust network for document clearing prevents costly rejections and saves significant time.

Step 4: Drafting and Notarizing the Memorandum of Association (MOA)

The MOA is the founding legal document.

Content: It outlines the company’s constitution, shareholding structure, business activities, and management rules.

Mainland LLC Requirement: For a Mainland LLC, the MOA must be bilingual (English and Arabic) and signed before a Notary Public in the UAE.

Step 5: Securing a Physical Office Space (Ejari/Tenancy)

A registered physical address is mandatory for all UAE company formations.

Mainland: You must lease office space and register the tenancy contract with the Ejari system. The registered Ejari is a prerequisite for final license issuance.

Free Zone: Requires a physical presence, ranging from a dedicated office to a cost-effective Flexi-Desk facility within the specific Free Zone premises.

Step 6: Final Submission & Trade License Issuance

With all prerequisites met, the final application is submitted.

Final Package: Includes the Initial Approval, Attested Parent Company Documents, Signed MOA, Ejari/Tenancy Contract, and passport copies of the Manager/Shareholders.

Issuance: Upon successful review, the authority issues a payment voucher. Once paid, your Trade License is officially issued. Your Subsidiary Company in UAE is now a legal entity!

Step 7: Post-Licensing Formalities (Operational Readiness)

The license is a milestone, but operational readiness follows.

Immigration & Labour: Register with the Immigration and Labour Departments to secure your Establishment Card. This is necessary to begin the Employee Visa process.

Corporate Bank Account: Open a Corporate Bank Account for all financial transactions—a challenging step where specialized assistance is invaluable.

Corporate Tax Registration: Register your new entity with the Federal Tax Authority (FTA) to receive a Tax Registration Number (TRN), ensuring compliance with the new UAE Corporate Tax law

When WEATHERTECH ENGINEERING Services Ltd, a mid-sized European engineering consultancy, decided to expand into the UAE, their goal was to establish a fully compliant subsidiary that could bid for government and private-sector infrastructure projects.

Key Challenge:

Their parent-company documents were spread across multiple jurisdictions, and they were unsure whether to choose a Mainland structure or a specialized Free Zone.

Our Approach:

- Conducted a jurisdiction assessment to match their project-based business model.

- Guided their team through MOFA and Embassy attestation of all corporate documents.

- Structured a Mainland LLC subsidiary to allow local project execution and tender participation.

- Fast-tracked office space (Ejari) and Establishment Card issuance.

Result:

The entire subsidiary setup was completed in 18 days, enabling WEATHERTECH ENGINEERING to immediately register with major UAE contracting authorities and begin onboarding engineers under their new entity.

Key Takeaway:

For companies entering the UAE project, engineering, or consulting sector, choosing the right entity structure and completing attestation correctly can accelerate market entry by weeks.

The Trade License is the legal start, but the Establishment Card and Employee Visas are the keys to physical operation. Successfully navigating the Immigration and Labour Departments is crucial for your UAE business subsidiary. Here let’s explain the post licensing formalities in detail.

Step-by-Step UAE Visa Process for Your Subsidiary Manager

The process for obtaining a residency visa for your appointed General Manager (or any employee) involves sequential steps regulated by the Ministry of Human Resources and Emiratisation (MoHRE) and the Federal Authority for Identity, Citizenship, Customs & Port Security (ICP).

| Step | Formal Name & Authority | Purpose & Impact |

|---|---|---|

Establishment Card | ICP / Immigration | Mandatory first step. Registers your new subsidiary as an entity eligible to hire foreign employees. This card is essential for all subsequent visa applications. |

| Employment Contract & Quota | MoHRE | The subsidiary applies to MoHRE to secure a Visa Quota (permission to hire). The job offer and official contract are registered here. |

| Entry Permit (e-Visa) | ICP | The approval needed for the manager to enter the UAE or change their visa status without leaving the country. This grants 60 days to complete the remaining steps. |

| Status Change | ICP | If the manager is already in the UAE on a visit visa, their residency status must be formally adjusted before the medical process begins. |

| Medical & Biometrics | Government Medical Centre | The mandatory Medical Fitness Test (for infectious diseases) and submission of biometrics for the Emirates ID. |

| Final Visa Stamping | ICP | Once all checks are clear, the residency visa is formally stamped into the passport and linked to the Emirates ID. This grants the General Manager their 1 or 2-year UAE residency. |

Key Takeaway: The entire process starts with the Establishment Card. Without it, your Subsidiary Company in UAE cannot sponsor any employee or investor visas. Securing the Establishment Card in Dubai is an essential step.

This is the most critical area of ongoing compliance. Understanding Corporate Tax (CT) and Economic Substance Regulations (ESR) is vital for a Free Zone subsidiary to maintain its tax benefits.

Corporate Tax (CT) Registration

Every registered Subsidiary Company in UAE must register with the Federal Tax Authority (FTA), regardless of whether they expect to pay 0% or 9% tax.

1. Mainland Subsidiary Tax Status (Standard Rate)

Mainland entities are subject to the standard, predictable tiered corporate tax structure:

0% CT Rate: Applies to taxable income up to AED 375,000. This threshold supports SMEs and new subsidiary company operations.

9% CT Rate: Applies to taxable income exceeding AED 375,000.

Note: Mainland companies are generally taxed on their worldwide income, though double taxation avoidance treaties may apply.

2. Free Zone Subsidiary Tax Status (The QFZP Test)

Free Zone Companies can benefit from preferential rates, but only if they comply strictly with the rules to be recognized as a Qualifying Free Zone Person (QFZP).

0% CT Rate: The sought-after rate for Qualifying Income.

9% CT Rate: Applies to taxable income that is Non-Qualifying Income or if the company fails the QFZP Test.

The QFZP Test: Maintaining the 0% Rate

To be recognized as a Qualifying Free Zone Person, your subsidiary must adhere to three main criteria:

Qualifying Income: The majority of its income must come from “Qualifying Activities” (e.g., international trade, headquarters services). Local sales to the Mainland are often considered Non-Qualifying Income.

Adequate Substance: The subsidiary must maintain sufficient Economic Substance in the UAE (adequate employees, physical assets, and operational expenditure).

De Minimis Rule: The total Non-Qualifying Income must not exceed the threshold of AED 5 million or $5\%$ of total revenue, whichever amount is lower. Failure to meet this rule triggers the 9% tax rate on all income.

Economic Substance Regulations (ESR)

If your subsidiary conducts a Relevant Activity (e.g., holding company business, headquarters, distribution/service center), it must file an annual ESR Notification and potentially an ESR Report to confirm it has genuine economic activity in the UAE.

Compliance Risk: Non-compliance with ESR or failure to maintain QFZP status can result in severe financial penalties and the loss of tax exemptions, making expert consultation mandatory, regardless of your chosen jurisdiction.

Documents Required for Setting Up a UAE Subsidiary Company

Navigating the documentation phase is key to a smooth launch of your UAE business subsidiary. The most frequent hurdle in the process of how to set up a Subsidiary Company in UAE is ensuring the parent company’s documents are correctly Attested and legally recognized.

Here is the essential document checklist, categorized for clarity, to ensure your application sails through the DET or Free Zone Authority approval stages.

A. Corporate Documents (Must Be Attested/Legalized)

These foundational documents verify the existence and authority of the foreign Parent Company and must undergo the multi-step Attestation process (Notarization, UAE Embassy legalization, and final MOFA stamp in the UAE).

| Document | Purpose/Requirement |

|---|---|

Certificate of Incorporation/Registration | Confirms the legal existence of the Parent Company in its home country. |

Memorandum & Articles of Association (MOA & AOA) | Details the Parent Company's objectives, structure, and internal governance. |

Certificate of Good Standing (or Incumbency) | Verifies the Parent Company is active and compliant with regulations in its home jurisdiction (often required to be less than 6-12 months old). |

Board Resolution | A formal, signed and attested decision by the Parent Company's Board approving three key actions: 1) The formation of the new Subsidiary Company in UAE. 2) The appointment of the General Manager. 3) The delegation of signing authority. |

Power of Attorney (POA) | An attested legal document granting specific powers to the appointed General Manager (or a legal representative/consultant) to act on the Parent Company's behalf (e.g., signing documents, opening the Corporate Bank Account). |

Audited Financial Statements | Copies of the Parent Company's Audited Accounts (typically for the last one or two years) to demonstrate financial stability. |

To ensure a smooth process, prepare the following documents from the parent company:

B. Personal Documents (For Key Personnel)

These documents are required for the individuals who will manage and own the UAE business subsidiary.

- Passport Copies: Clear, color copies of the passports for all directors, shareholders (individuals), and the appointed General Manager of the new subsidiary.

- UAE Visa/Entry Stamp: Copy of the manager’s current UAE entry stamp or residence visa page (if applicable).

- Manager’s CV & Educational Certificates: A detailed CV and copies of educational certificates for the appointed General Manager are often required, especially for professional and service activities, and for their Employee Visa application.

Remember, the most common pitfall when starting a Subsidiary Company in UAE is incomplete or incorrect Document Attestation. The DET or Free Zone Authority will reject documents that are not fully legalized through the entire chain:

Notary Public ➡ ️ Relevant Ministry in Home Country (e.g., Foreign Affairs) ➡ ️ UAE Embassy ➡ ️ Ministry of Foreign Affairs (MOFA) in the UAE.

Ensuring these core documents are in English or Arabic (or legally translated) and properly attested is the fastest way to progress from Initial Approval to final Trade License issuance.

“Based on internal project analysis from the past 12 months, 62% of subsidiary setup delays came from document attestation issues — not licensing or approvals.

Whether it is a mainland license or a free zone license, the completion time has recently averaged 14–18 days, compared to the usual 7–10 days.

What this means for you: If your parent-company documents are fully attested before submission, you can reduce your setup timeline by up to 40%, giving your business a significant advantage when entering the UAE market,” said Essa Al Harthy, CEO of Best Solution Business Setup Consultancy.

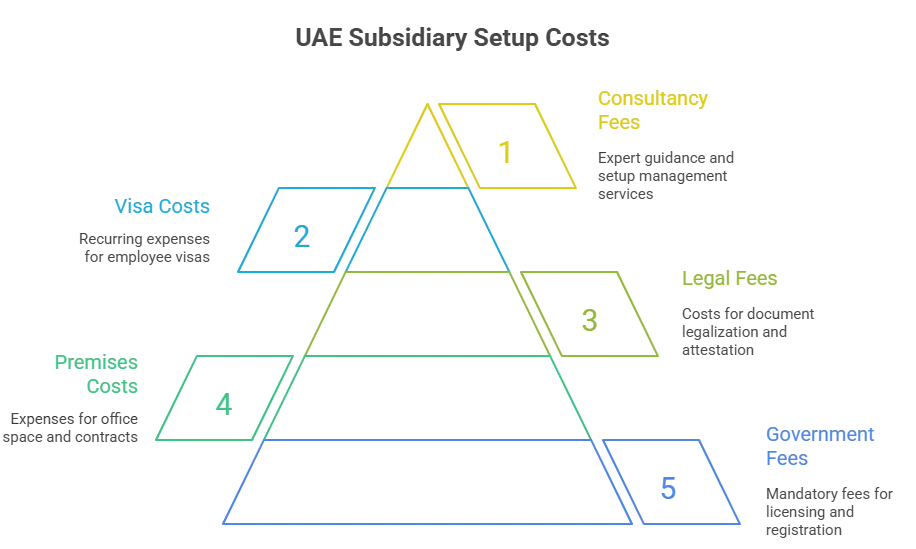

Understanding the Costs of Starting a Subsidiary Company in UAE

Cost Category 1: Government & Licensing Fees

These are mandatory fees paid to the respective Licensing Authority (DET for Mainland or a specific Free Zone Authority).

Trade Name Reservation: A one-time fee to secure your desired company name.

Initial Approval: The application fee for government pre-approval of your concept and key personnel.

Trade License Fee: The largest and most variable annual government expense.

Varies significantly based on the Business Activity (Commercial, Professional, Industrial) and the jurisdiction (e.g., a General Trading License is typically more expensive than a single-activity service license).

Chamber of Commerce Fee: An annual mandatory fee (e.g., to the Dubai Chamber for Mainland companies).

Establishment Card Fee: A one-time fee for registering your new entity with the Immigration and Labour Departments, essential for applying for Employee Visas.

Cost Category 2: Premises & Statutory Requirements

All subsidiaries need a physical address, leading to these mandatory costs:

Office Rental Fees: The annual lease payment for your workspace.

Mainland: Requires a dedicated physical office with an Ejari (registered tenancy contract).

Free Zone: May range from an affordable Flexi-Desk or Co-working Space to a dedicated office, depending on the package.

Ejari Registration Fees (Mainland Only): The governmental fee for registering the tenancy contract with the Dubai Land Department.

Cost Category 3: Legal & Attestation Fees (The #1 Source of Document Costs)

This expense covers the complex legalization of the parent company’s documents. These costs are charged per document and vary based on the country of origin.

Notarization & LCost Category 2: Premises & Statutory Requirements

All subsidiaries need a physical address, leading to these mandatory costs:

Office Rental Fees: The annual lease payment for your workspace.

Mainland: Requires a dedicated physical office with an Ejari (registered tenancy contract).

Free Zone: May range from an affordable Flexi-Desk or Co-working Space to a dedicated office, depending on the package.

Ejari Registration Fees (Mainland Only): The governmental fee for registering the tenancy contract with the Dubai Land Department.

ocal Attestation: Fees in the parent company’s home country.

UAE Embassy Attestation: Fees charged by the UAE Embassy in the home country to legalize corporate documents.

MOFA Attestation: Final fees charged by the Ministry of Foreign Affairs (MOFA) in the UAE to complete the legalization chain.

Cost Category 4: Visa & Employee Costs

These recurring costs are necessary for the appointed General Manager and any employees.

Investor/Employee Visa Fees: Covers the cost of the residence visa application, including the Immigration security deposit (if applicable).

Medical Tests & Emirates ID: Mandatory government fees for the health check and issuance of the national identity card.

Labour Card/Contract Fees: Fees for the final employment contract registration with the Ministry of Human Resources and Emiratisation (MoHRE).

Cost Category 5: Professional Consultancy & Service Fees

This covers the critical expert handling of the entire process.

End-to-End Setup Management: Our fixed professional fee covers expert guidance, complex document processing, dealing with multiple Government Ministries, and managing the entire setup process—ensuring it is done right the first time.

Bank Account Assistance: Dedicated support to navigate the often-challenging process of opening a Corporate Bank Account.

Tax Registration: Assistance with registering the company for Corporate Tax and/or VAT with the Federal Tax Authority (FTA).

🤝Our Transparency Promise: We provide a detailed, all-inclusive custom quotation upfront, clearly distinguishing between government fees and professional service fees. This ensures you know exactly what to expect before committing to your company formation in the UAE.

Navigating the intricacies of UAE company formation requires precision. Many businesses, especially when attempting a DIY approach or working with inexperienced providers, fall victim to common, costly mistakes. Avoiding these pitfalls is crucial for a smooth launch of your UAE business subsidiary.

Here are the critical errors to look out for when asking yourself how to set up a Subsidiary Company in UAE correctly:

1. Incorrect Jurisdiction Choice: The Operational Killer

The Mistake: Choosing a Free Zone Company solely for the 0% Corporate Tax benefit, only to realize later that your business model requires direct, frequent sales or retail presence in the UAE Mainland.

The Consequence: Your operations are crippled. You are forced to rely on expensive local distributors or establish a costly Mainland Branch, negating the initial savings and limiting growth potential.

The Avoidance: Base your jurisdiction selection (Mainland vs. Free Zone like DMCC, JAFZA) entirely on your target market and sales channel (e.g., Mainland for retail/government contracts; Free Zone for international trade/services).

2. Improper Document Attestation: The Delay Nightmare

The Mistake: Failing to follow the precise, multi-stage legalization chain for the Parent Company’s corporate documents (e.g., skipping the UAE Embassy or MOFA stamp, or having mismatches in names).

The Consequence: Your application will be rejected by the DET or Free Zone Authority. This leads to significant financial penalties, months of costly delays, and a complete halt to the Trade License issuance process.

The Avoidance: Treat Document Attestation as a non-negotiable legal requirement. Use experts to ensure all parent company documents (MOA, Board Resolution, POA) are legalized in the correct order.

3. Vague or Incorrect Business Activities on the License

The Mistake: Using broad or generic descriptions, or accidentally omitting a key activity your UAE business subsidiary plans to undertake (e.g., licensing a “Consultancy” firm that also plans to engage in “General Trading”).

The Consequence: Your company risks heavy fines, license suspension, or a refusal to renew. Crucially, your company’s inability to legally perform its core functions will cause severe banking restrictions.

The Avoidance: Define all your business activities precisely and ensure they are covered by the correct Trade License type (Commercial, Professional, etc.) and approved by the respective authority.

4. Underestimating Corporate Bank Account Opening Timelines

The Mistake: Assuming the bank account will open immediately after the Trade License is issued. UAE banks operate under some of the world’s strictest KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance checks.

The Consequence: Account opening can take 4-12 weeks. Without a functioning Corporate Bank Account, you cannot pay rent, remit capital, or start commercial operations, effectively delaying your market entry by months.

The Avoidance: Prepare all bank-required documents (Parent Company bank statements, detailed business plan, source of funds documentation) before the license is finalized. Seek assistance from a consultancy that provides dedicated Bank Account Opening Assistance.

5. Ignoring Post-Setup Compliance & Tax Regulations

The Mistake: Focusing only on the license and forgetting ongoing obligations like Economic Substance Regulations (ESR) reporting, Ultimate Beneficial Owner (UBO) declarations, or Corporate Tax registration with the Federal Tax Authority (FTA).

The Consequence: Severe financial penalties, license non-renewal, and potentially having your bank accounts restricted or frozen.

The Avoidance: Establish a strict compliance calendar and ensure you register for Corporate Tax (if applicable) immediately after your company is formed.

Choosing the subsidiary company in UAE structure is not merely a legal checkbox—it is the foundational strategic business decision for a secure expansion. For the parent company, the benefits center on risk-mitigation and operational control.

1. Limited Liability Protection (Financial Firewall)

This is the most critical benefit for a corporate decision-maker. Because the subsidiary is a separate legal entity (often a Limited Liability Company – LLC), its financial and legal liabilities are distinct. This establishes a financial firewall, effectively shielding your parent company’s assets from debts, disputes, or legal challenges associated with the new UAE venture.

2. 100% Foreign Ownership and Full Control

Thanks to recent UAE legal reforms, establishing a subsidiary company in most Mainland sectors and all Free Zones guarantees 100% foreign ownership. This removes the former mandatory requirement for a local Emirati partner, ensuring the parent company maintains full control over profits, operations, management, and long-term business direction.

3. Enhanced Credibility and Market Presence

Operating as a locally incorporated legal entity significantly enhances your market perception. Registration with the Department of Economy and Tourism (DET) or a recognized Free Zone Authority (FZA) signals a long-term commitment to the region. This increased Authority (A) and Trustworthiness (T) is vital for securing large contracts, dealing with government bodies, and successfully navigating the challenging process of corporate bank account opening.

4. Operational and Business Scope Flexibility

Unlike a restrictive Branch Office, the subsidiary possesses the flexibility to adopt a diverse range of business activities that may differ from its parent company. This allows the subsidiary to rapidly diversify and adapt its service offerings to the specific demands of the UAE market and pursue specialized Trade Licenses.

Choosing the right jurisdiction is the foundational strategic decision for your UAE business subsidiary. The distinction between a Mainland Company and a Free Zone Company directly impacts your market access, tax liability, and operational flexibility.

The question of how to set up a Subsidiary Company in UAE largely hinges on one factor: Where are your customers?

Jurisdiction Comparison: Mainland vs. Free Zone

Here is a clear breakdown to help you decide which structure offers maximum growth potential and operational efficiency for your business setup in Dubai or other Emirates.

| Feature | Mainland Subsidiary | Free Zone Subsidiary |

|---|---|---|

| Primary Licensing Authority | Department of Economy and Tourism (DET) or equivalent Emirate DED (Department of Economic Development) | Specific Free Zone Authority (e.g., DMCC, JAFZA, DIFC, DAFZA) |

| Market Access (Trading) | Direct, unrestricted trade across the entire UAE market and internationally. Eligible for Government Contracts/Tenders. | Can trade within its Free Zone and internationally. To trade in the UAE Mainland, it must appoint a local distributor/agent or open a costly Mainland branch. |

| Foreign Ownership | 100% Foreign Ownership is now standard for most commercial and industrial activities (no local sponsor required). | 100% Foreign Ownership is standard across all sectors and has been for years. |

| Corporate Tax (CT) | Subject to the 9% UAE Corporate Tax on taxable income exceeding AED 375,000. | Often eligible for 0% Corporate Tax on 'Qualifying Income' (e.g., international trade, services to other Free Zones). Subject to 9% on non-qualifying income above the threshold. |

Physical Office | A physical office space with an Ejari (attested tenancy contract) is mandatory. | A physical office or a cost-effective Flexi-Desk within the specific Free Zone is required. |

Approvals & Compliance | Requires dealing with the DET/DED and multiple external Government Ministries (e.g., Ministry of Health) for specific activities. | Deals with the streamlined, one-stop-shop Free Zone Authority for all licensing, visas, and operational approvals. |

Best For (Target Customer) | Businesses selling goods/services directly to the UAE consumer/B2B market, opening retail outlets, or requiring a physical presence across the Emirates. | Businesses focused purely on international trade, export/import, holding Intellectual Property (IP), or serving a global clientele without requiring direct Mainland sales. |

Expert Takeaway

The choice between a Mainland and Free Zone subsidiary company in UAE must be driven by a comprehensive analysis of your business model, target market, and supply chain.

As our General Manager and senior consultant advises, “The choice between Mainland and Free Zone is the foundation of your UAE strategy. We analyze a client’s entire business model—from their target customers to their supply chain—to recommend the jurisdiction that offers maximum growth potential and operational efficiency.”

If you prioritize direct access to the lucrative UAE consumer market and government contracts, the Mainland is your ideal starting point. If you prioritize international trade, minimal taxation, and streamlined compliance, a Free Zone (and becoming a QFZP) is likely the better fit.

Setting up a subsidiary in the UAE is the most powerful strategic move you can make to position your business for significant growth…

While the blueprint for how to set up a Subsidiary Company in UAE is detailed, it doesn’t have to be difficult or stressful. With the right expert guidance, you can seamlessly navigate the complexities of DET registration, Free Zone Authority requirements, Document Attestation, and securing your Corporate Bank Account.

Don’t let administrative hurdles… slow down your global ambitions. Let our team handle the complexities of compliance, so you can focus on what you do best: turning your UAE vision into a lucrative reality.

Ready to Launch Your UAE Subsidiary?

Take the next, crucial step toward 100% Foreign Ownership and a successful UAE company formation.

➡️ Click here to contact Best Solution today for a free, no-obligation consultation and receive your personalized roadmap for your Subsidiary Company in UAE setup!

Frequently Asked Questions

How long does it take to set up a subsidiary in the UAE?

With all documents correctly prepared and attested, the license can be issued in as little as 2-3 working days for some free zones and 5-10 working days for the mainland. The entire process, including document attestation and bank account opening, typically takes 3-6 weeks.

Can a subsidiary in a UAE free zone do business in the mainland?

A free zone subsidiary cannot trade directly in the mainland market. To do so, it must partner with a mainland distributor or agent, or open a branch of its free zone company on the mainland.

Is a local Emirati sponsor required for a subsidiary?

For most business activities on the mainland, a local sponsor is no longer required, and 100% foreign ownership is permitted. For professional service licenses, a Local Service Agent (LSA) is still required, but they hold no shares or control in the company.

How to open a subsidiary company in the UAE?

Choose the right jurisdiction (Mainland or Free Zone), complete document attestation, draft a Memorandum of Association, secure office space, and obtain your Trade License.

How do I create a subsidiary company?

A subsidiary is established as a separate legal entity under UAE law, typically as an LLC, with ownership and management defined by the parent company.

What are the requirements for a subsidiary?

Required documents include the parent company’s Certificate of Incorporation, MOA & AOA, Board Resolution, Power of Attorney, and attested personal documents of key personnel.

How much ownership does it take to be a subsidiary?

A subsidiary is usually majority-owned or wholly owned (often 100%) by the parent company.

Is a subsidiary 100% owned?

Yes, most UAE subsidiaries can be 100% foreign-owned, depending on the jurisdiction and business activity.

What are the risks of a subsidiary?

Risks include operational compliance failures, document attestation delays, financial liability for the subsidiary, and misalignment with parent company strategy.

References

- Corporate Tax (CT) in UAE

- Corporate Tax in UAE

- Federal Tax Authority (FTA)

- Economic Substance Regulations (ESR) in UAE

- Dubai Department of Economy and Tourism (DET)

- Visa and Emirates ID

Disclaimer : This guide provides a general information . Regulations and costs may change time to time based on government rules, so consult the best solution’s professional Business Setup consultants for the latest updates. Refer to the glossary for definitions of key terms which is mentioned in this article. Refer to the glossary for definitions of key terms.