Are you an investor or entrepreneur looking to establish a secure, growth-focused presence in the Middle East? . The United Arab Emirates, a country has firmly established itself as a world-leading destination for attracting Foreign Direct Investment (FDI). When setting up a business in this dynamic market, securing the optimal legal structure is the most critical decision an investor will make.

The Limited Liability Company (LLC) formation in Dubai stands out as the most popular and flexible choice.This is more than just securing a trade license; it’s about leveraging a sophisticated, pro-business ecosystem.

In this essential guide, we cut through the confusion. We’ll explore exactly why the LLC company formation in Dubai offers unmatched stability, credibility, and profit repatriation benefits.

What Is an LLC in Dubai?

A Limited Liability Company (LLC) is a legal business structure where the liability of each When investors explore LLC company formation in Dubai, one of the first things they want to understand is what an LLC actually means in the UAE context. A Limited Liability Company (LLC) is one of the most common and investor-friendly business structures in the Dubai Mainland, offering entrepreneurs the flexibility to operate across the UAE while enjoying strong legal protection and commercial credibility.

An LLC in Dubai is a business entity where the liability of shareholders is limited to their shares in the company’s capital-unlike a sole proprietorship where personal liability is unlimited. This structure is widely preferred by foreign investors because it allows them to conduct a wide range of business activities—from general trading and contracting to retail, manufacturing, marketing, and consultancy services. With the UAE’s updated commercial laws, LLCs now offer 100% foreign ownership in most sectors, making Dubai even more attractive for global entrepreneurs.

Unlike Free Zone companies, a Mainland LLC enables you to trade directly within the UAE market and take on government projects, giving your business broader opportunities for growth. The setup process is regulated by the Dubai Department of Economy and Tourism (DET), ensuring a streamlined and transparent company formation experience.

Whether you’re looking to expand your international operations, build a local presence, or access Dubai’s thriving economy, an LLC offers the perfect blend of flexibility, scalability, and market access—making it a top choice for long-term business success in the UAE.

Why Choose an LLC in Dubai?

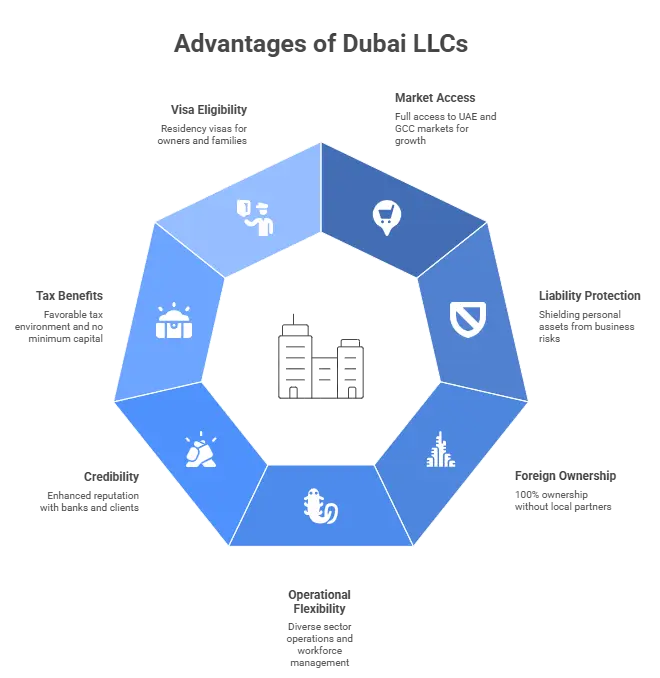

- Full Local Market Access & Business Opportunities:

- An LLC registered on the Dubai Mainland allows you to trade directly across the entire UAE and the GCC region.

- This is essential for long-term growth, engaging with local clients, and bidding for major government contracts in Dubai.

- Robust Limited Liability Protection:

- The structure provides crucial Limited Liability Protection for shareholders, shielding personal assets (such as property or savings) from the company’s debts and financial risks.

- This protection is a cornerstone of secure business setup in Dubai for foreign investors.

- 100% Foreign Ownership (A Key Investor Benefit):

- Thanks to recent regulatory updates, Mainland LLC company formation in Dubai now permits 100% foreign ownership in most sectors, offering full control without the need for a UAE National partner.

- Flexibility in Business Operations & Activities:

- An LLC can operate across a vast range of sectors, including trading, manufacturing, and professional services.

- This flexibility supports expansion, diversification, and the ability to hire a full workforce and staff in the UAE.

- Enhanced Credibility and Corporate Trust:

- The LLC status and regulation by the Dubai Department of Economy and Tourism (DET) instantly boost your firm’s reputation with banks, high-value clients, and institutional partners.

- This greatly facilitates the corporate bank account opening process in Dubai.

- Favorable Tax & Capital Structure:

- Dubai offers a favorable tax environment, with no personal income tax and a competitive corporate tax rate (0% on profits up to AED 375,000 for SMEs).

- There are No Minimum Capital Requirements typically enforced for most activities, making the initial setup cost manageable for startups and SMEs.

- Investor & Residency Visa Eligibility:

- LLC owners can sponsor UAE residency visas for themselves, their employees, and their families, simplifying the relocation process for global entrepreneurs.

- This makes the Dubai LLC setup an ideal pathway for gaining long-term residency.

Real Results: How an E-Commerce Startup Hit AED 5M Revenue in 12 Months with a Mainland LLC

Real Success Story: How Muhammed Assaffi Built Ateeq Oud Perfumes LLC in Dubai Mainland

When it comes to understanding how a Dubai Mainland LLC can fuel real business growth, few examples are as inspiring as Ateeq Oud Perfumes LLC, founded by our client Mr. Muhammed Assaffi.

Mr. Assaffi approached us with a clear vision:

to create a premium oud and fragrance brand that could serve both the UAE market and international customers without restrictions. With expert guidance on company structure, activity mapping, and compliance, he chose the Dubai Mainland LLC model — the perfect fit for a fast-scaling retail and e-commerce business.

Why the Mainland LLC Structure Worked for Him

Freedom to Trade Anywhere in the UAE

Ateeq Oud Perfumes can operate seamlessly across Dubai, Abu Dhabi, Sharjah, and more — a major advantage over free zones.Multiple Revenue Routes: Retail + Online Sellers License

Although his business sells online, the official mainland activity falls under “Online Sellers”, giving complete legal coverage to sell across platforms like Instagram, website stores, Amazon AE, and Noon.Ease of Import & Distribution

As a fragrance company dealing with raw materials and finished perfumes, the mainland structure allowed smooth product clearance, warehouse leasing, and distribution.- Scalability for Future Branches

The LLC structure enables Mr. Assaffi to open kiosks, boutiques, and pop-up stores without restrictions — essential for a luxury perfume brand.

Result: A Fast-Growing Perfume Brand in Just 12 Months

Since inception, Ateeq Oud Perfumes LLC has grown rapidly, supported by:

Professional licensing & setup

Clear activity selection

Compliance-ready documentation

Smooth bank account opening

Strong UAE market access

This success story demonstrates how the right business structure can accelerate the growth of emerging brands in the UAE.

“Ateeq Oud Perfumes LLC’s journey perfectly illustrates the difference between simply starting a business and strategically positioning a business. Choosing the Mainland LLC from day one was the critical step that allowed them to engage the entire UAE market and achieve this rapid growth. We don’t just register companies—we guarantee banking compliance. Solve your biggest hurdle from day one.” — Vipin Kumar, General Manager, Best Solution Business Setup Consultancy.

Types of Trade Licenses for LLC in Dubai

When forming an LLC company in Dubai, one of the most important steps is choosing the right trade license. Your trade license determines the scope of activities your business can legally conduct and ensures compliance with UAE commercial laws. The Department of Economic Development (DED) regulates the issuance of trade licenses for LLCs, and each license type is tied to specific business activities.

Selecting the appropriate license is essential for legal operations, taxation, and corporate credibility, and it also affects the ability to open bank accounts, sign contracts, and sponsor visas. An LLC structure is only available for specific license categories, mainly

1. Commercial License

A commercial license is designed for LLCs engaged in trading activities, including import, export, retail, wholesale, and general trading.

Ideal for retail shops, e-commerce businesses, and distributors.

Allows you to buy, sell, and trade goods within Dubai and across the UAE.

Example: A company selling electronics, fashion items, or FMCG products would require a commercial license.

2. Professional License

A professional license is issued for service-based businesses that rely on professional expertise. This license allows 100% foreign ownership in certain professional sectors.

Suitable for consultancy, IT services, legal firms, accounting, and engineering services.

Enables LLCs to provide specialized services directly to clients.

Example: An IT consultancy or management advisory firm would operate under a professional license.

3. Industrial or Manufacturing License

An industrial license is granted to LLCs involved in manufacturing, production, or industrial operations.

Ideal for businesses producing goods, machinery, or construction materials.

Required for factories, warehouses, and production units.

Ensures compliance with municipality regulations and industrial safety standards.

4. Tourism License (Optional for LLCs in Tourism Activities)

If your LLC operates in tourism, hospitality, or travel-related services, a tourism license is required.

Covers hotels, travel agencies, tour operators, and recreational businesses.

Regulated by the Department of Tourism and Commerce Marketing (DTCM).

Key Tips to Remember About Trade Licenses

Your business activity determines the license type, so choose the business activity carefully.

Some businesses may require additional approvals from authorities like Dubai Municipality, Ministry of Health, or other specialized regulatory bodies.

Trade licenses affect corporate bank accounts, visa sponsorship, and contractual authority, making them central to smooth business operations.

The DED handles commercial and professional licenses, while specialized sectors may involve other entities.

Legal Requirements for LLC Formation in Dubai

To register an LLC, you must meet the following legal requirements:

- Shareholders & Partners

- Minimum 1 and maximum 50 shareholders

- UAE national ownership of 51% (except in sectors with 100% foreign ownership) UAE national ownership is only required for a few specific strategic sectors.

- Minimum 1 and maximum 50 shareholders

- Capital Requirements

- Minimum share capital: AED 300,000 (varies based on business activity)

- Minimum share capital: AED 300,000 (varies based on business activity)

Note: Tax laws (Corporate Tax) and capital requirements are subject to change by the UAE Cabinet. Consult our site or contact us for the latest figures.

- Local Sponsor / Service Agent

- Required for sectors where UAE national ownership is mandatory((No requirement for 51% ownership))

- Can be an individual or a corporate entity

- Required for sectors where UAE national ownership is mandatory((No requirement for 51% ownership))

- Office Space Requirement

- Physical office space is mandatory for licensing and must be registered with Ejari.

- Business License

- Must obtain a commercial trade license or professional license from the Department of Economic Development (DED)

Step-by-Step Process of LLC Company Formation in Dubai

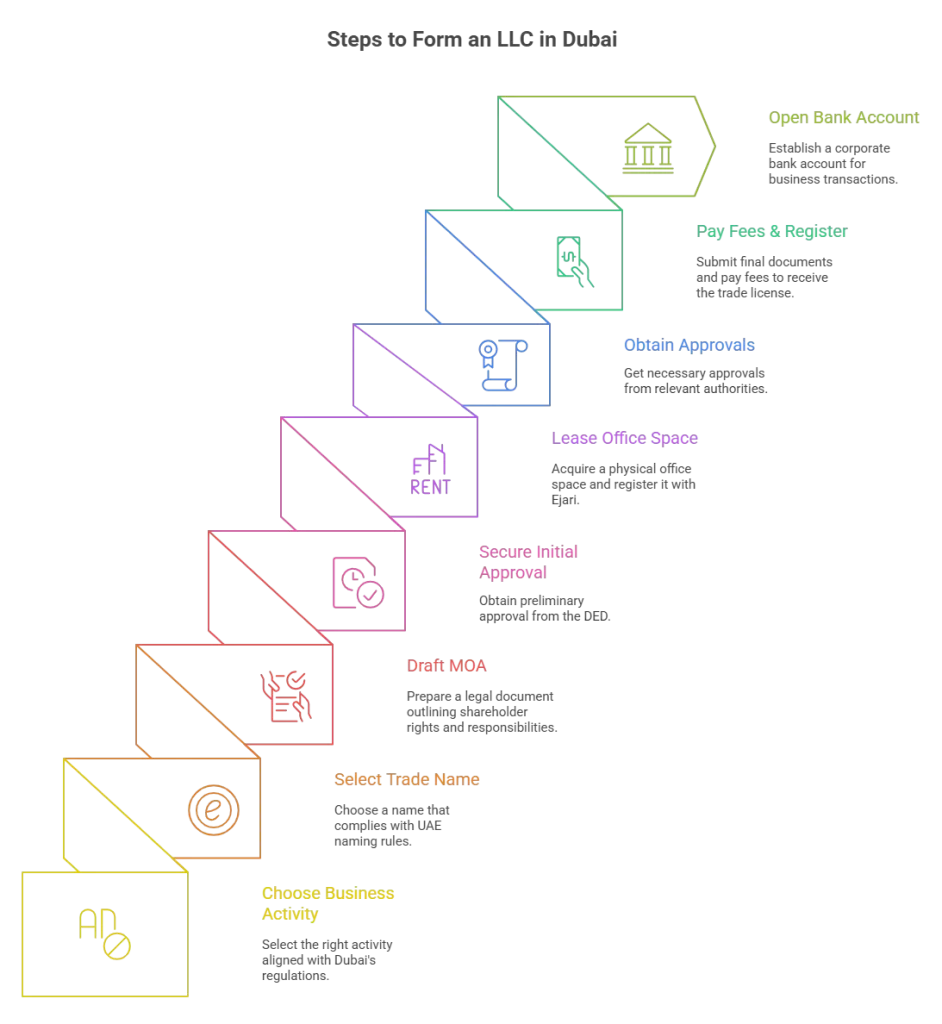

Starting an LLC company in Dubai is a structured process governed by the UAE Commercial Companies Law and regulated by the Department of Economic Development (DED). Understanding the steps ensures legal compliance, smooth operations, and faster business setup. Here’s a comprehensive, step-by-step guide for entrepreneurs and foreign investors looking to establish an LLC in Dubai.

1.Choose Your Business Activity

Your business activity defines what your LLC is legally allowed to do in Dubai. It must align with the list of approved activities issued by the Dubai Department of Economy and Tourism (DET). Selecting the right activity ensures you receive the correct trade license and determines whether the LLC structure is permitted for your business.

Once finalized, the chosen activity guides the rest of the formation process, including approvals, licensing, and documentation.

2. Select a Trade Name

Choose your trade name that represents your brand and must comply with UAE naming regulations.

Names should reflect the company’s activities and should not include offensive terms or references to political or religious groups.

Once selected, the trade name must be approved by the DED before proceeding to registration.

3. Draft the Memorandum of Association (MOA)

The MOA is a legal document that outlines:

Shareholders’ rights and responsibilities

Capital structure and contribution

Business activities and operational scope

For LLCs, the MOA must be notarized and submitted to the DED. This document ensures clarity among partners and is a key requirement for registration.

4. Secure Initial Approval

Before proceeding, the DED grants preliminary approval to ensure your business activity and trade name comply with regulations.

This approval confirms that the proposed LLC structure, ownership, and activity are acceptable under UAE law.

Required documents include passport copies of shareholders, MOA draft, and initial application forms.

5. Lease Office Space and Obtain Ejari

A physical office space is mandatory for LLC registration.

You must sign a tenancy contract for your office space and register it with Ejari, the official system for tenancy contracts in Dubai.

The office must meet the requirements for your business activity and allow inspections by authorities if needed.

6. Obtain Approvals from Relevant Authorities

Certain business activities require additional approvals from government authorities.

- For example, food businesses may require approvals from the Dubai Municipality, healthcare services from the Ministry of Health, and education services from the Knowledge and Human Development Authority (KHDA).

- Ensuring all approvals are obtained before license issuance avoids delays in operations.

7. Pay License Fees & Register the Company

Once approvals are in place, you must:

- Submit final documents to the DED

- Pay the required trade license fees

- Receive the official trade license, making your LLC legally operational

Fees vary depending on business activity, office location, and capital structure.

8. Open a Corporate Bank Account

A corporate bank account is essential for:

- Depositing company capital

- Conducting business transactions

- Sponsoring visas for owners and employees

Banks may require the trade license, MOA, and shareholder documents to open the account.

Costs of Forming an LLC in Dubai

Establishing an LLC company in Dubai is a strategic investment that provides access to one of the fastest-growing business markets in the world. Understanding the costs involved in setting up a business in Dubai is essential for planning and budgeting, whether you are a local entrepreneur or a foreign investor.

The total cost of forming an LLC in Dubai depends on several factors, including business activity, office location, number of visas, and ownership structure. On average, investors can expect to spend between AED 12,000 to AED 50,000 for a standard setup, covering registration, licensing, office rental, and administrative fees. Larger trading companies or businesses with multiple visas and employees may incur higher costs.

Common Challenges in LLC Formation and How to Avoid Them

Setting up an LLC in Dubai offers tremendous opportunity — but it’s not always smooth sailing. Entrepreneurs often stumble over regulatory hurdles, documentation issues, or banking delays. Recognizing the most common pitfalls ahead of time can save you a lot of frustration, money, and time. Here are the key challenges and strategies to avoid them:

- Ownership Conflicts and Shareholder Disputes

Challenge: Disagreements arise from vague responsibilities or profit-sharing details in the initial agreement.

How to Avoid It: Draft a well-structured Memorandum of Association (MOA) defining rights, roles, and exit strategies from the start.

- Regulatory Approval Delays

Challenge: Failure to identify required external approvals (e.g., Municipality, Ministry of Health) for specific business activities.

How to Avoid It: Work with a licensed setup consultant who can proactively manage and secure authority-level approvals in the UAE.

- Office Lease Issues & Valid Address

Challenge: Using unverified virtual offices risks license rejection, as the DED requires a physical, compliant space.

How to Avoid It: Use certified commercial spaces, and always verify your tenancy contract with Ejari registration.

- Complex Bank Account Opening & Delays

Challenge: Banks perform deep due diligence, often rejecting applications due to incomplete KYC documentation or perceived lack of local substance.

How to Avoid It: Prepare a full, clean KYC package (MOA, Ejari, business plan) early and engage banks experienced in business banking for foreign LLCs

Our analysis shows that regulatory hurdles are common, but they are not the main showstopper. A recent survey of our clients revealed that 4 out of 10 new LLC owners experienced significant delays—not from the DED—but purely during the corporate bank account opening process. This is why our strategy focuses heavily on achieving ‘banking compliance’ well before your license is issued.

- Visa and Immigration Challenges

Challenge: Even though Dubai offers a wide variety of visa options for entrepreneurs and investors, mistiming the process—such as medical checks, Emirates ID registration, or underestimating visa quotas—can still cause significant operational delays.

How to Avoid It: Incorporate visa planning into your LLC formation timeline. Use a PRO service to handle applications and budget for all associated visa costs.

- Underestimating Hidden Costs & Cash Flow Risks

Challenge: Many entrepreneurs underestimate recurring costs like license renewals, PRO fees, and compliance expenses.

How to Avoid It: Create a realistic financial projection covering operating expenses for 6–12 months. Maintain a buffer fund to manage cash flow risk effectively.

- Choosing the Wrong Business Structure or Jurisdiction

Challenge: Selecting the wrong jurisdiction (Mainland vs. Free Zone) can lead to restrictions (e.g., on local trade) or bank difficulties.

How to Avoid It: Choose the right jurisdiction by evaluating your long-term business goals—whether targeting the local UAE market or global operations—and consult an experienced business setup advisor who understands license-activity mapping.

How to Mitigate All These Challenges: Practical Tips

Hire a Licensed Business Consultant: A professional consultant experienced consultancy in Dubai, can foresee regulatory risks, streamline documentation, and speed up approvals.

Use Strict Documentation Checklists: Maintain a clear, pre‑verified list of all required documents (MOA, trade license, Ejari, shareholder IDs, visas) — and double check before submission.

Pre-empt Bank Requirements: Prepare your bank application early, including a business plan, UBO (Ultimate Beneficial Owner) declarations, and proof of local presence.

Plan Your Cash Flow Carefully: Budget for both setup and recurring costs, including PRO services, visa renewals, license renewals, and operational expenses.

Choose the Right Office & Lease: Use legitimate, government-approved offices, register your contract with Ejari, and avoid “too-good-to-be-true” virtual addresses.

Monitor Regulatory Updates: Keep up to date with changes in UAE laws (ESR, corporate tax, AML) and engage local legal or tax advisors to remain compliant.

Why Overcoming These Challenges Matters

Tackling these common formation challenges not only ensures faster registration but also strengthens your operational foundation. A well-structured LLC built on clarity in ownership, compliance, and financial planning is more likely to:

- Attract investors — because your structure is legally sound.

- Open bank accounts smoothly — because your documentation and substance are solid.

- Scale efficiently — because you’ve planned for visas, licenses, and recurring costs from day one.

Documents Required to Start an LLC in Dubai, UAE

For LLC company formation in Dubai, preparing the right documents is critical to ensure a smooth and compliant registration process. The Dubai Department of Economy and Tourism (DET) requires a clear set of documents to verify shareholders, business activities, and legal agreements. Having all paperwork ready can prevent delays, speed up approvals, and streamline your business setup.

Key documents typically include:

- Passport Copies of Shareholders and Managers – Verified ID proof for all partners and company managers.

- No Objection Certificate (NOC) from Sponsors – Required if any shareholder is currently sponsored in the UAE.

- Draft Memorandum of Association (MOA) – Outlines shareholder rights, capital structure, and company activities; must be notarized.

- Initial Approval Certificate from DET – Confirms your business activity and trade name comply with UAE regulations.

- Trade Name Reservation Certificate – Official approval of your company’s registered name.

- Office Lease Agreement / Ejari Certificate – Proof of a physical office, mandatory for Mainland LLC registration.

- Special Approvals (if applicable) – Certain activities, like healthcare, education, or food, require additional authority approvals.

Having these documents organized not only ensures faster LLC company formation in Dubai but also establishes credibility with banks, government authorities, and potential clients.

Post-Setup Compliance: The Hidden LLC Checklist

Securing your trade license is just the starting line. Post-setup compliance is where sophisticated investors differentiate themselves from those who risk hefty fines and license suspension. Many guides overlook these mandatory, ongoing requirements for LLCs in Dubai. Staying compliant with these corporate governance regulations is essential for bank account health and long-term legal standing.

Here is the mandatory compliance checklist every Dubai LLC must follow:

Ultimate Beneficial Owner (UBO) Disclosure:

What it is: All LLCs must identify and disclose the individuals who ultimately own or control 25% or more of the company, or who exercise significant control.

Action: Submit a UBO declaration to the DET/DED (Mainland) or the respective Free Zone authority. Updates must be reported within 15 days of any change.

Corporate Tax Registration:

What it is: The UAE’s 9% Corporate Tax applies to most LLCs, with an exemption (0% rate) on profits up to AED 375,000 for SMEs.

Action: Register for Corporate Tax with the Federal Tax Authority (FTA) via the EmaraTax portal. Timeline: Within 30 days of the start of the taxable period.

Economic Substance Regulations (ESR) (Historical/Contextual):

Note: While the standalone ESR filing requirement was cancelled for fiscal years ending after December 31, 2022, understanding the spirit of economic substance is now vital for the Corporate Tax regime (especially for Qualifying Free Zone Persons) and general corporate governance.

Anti-Money Laundering (AML) Compliance:

What it is: Mandatory for businesses operating in designated non-financial businesses and professions (DNFBPs), such as real estate, auditing, and certain trading/consultancy activities.

Action: Companies must register with the Financial Intelligence Unit (FIU) via the goAML portal, appoint a Compliance Officer, and conduct enhanced Customer Due Diligence (CDD/KYC) on clients.

VAT Filing (If Applicable):

What it is: Mandatory registration if annual taxable supplies exceed AED 375,000.

Action: Register with the FTA. File returns monthly or quarterly depending on turnover, typically within 28 days of the end of the tax period.

LLC in Dubai: Mainland vs Free Zone

When investors begin exploring LLC company formation in Dubai, one of the most common questions is:

Whether an LLC applies only to the Mainland or if it also exists in Free Zones?.

The short answer: Yes, LLCs exist in both— but they operate under very different rules, authorities, and benefits. Understanding this distinction helps you choose the right business structure for your long-term operations in the UAE.

Mainland LLC (The Official and Traditional LLC Structure)

A Dubai Mainland LLC is the standard form of Limited Liability Company regulated by the Dubai Department of Economy and Tourism (DET). This is the most recognized business structure for investors who want full market access across the UAE. With updated commercial laws allowing 100% foreign ownership in most sectors, Mainland LLCs have become the preferred choice for trading companies, contracting firms, retail businesses, and service providers looking for broader commercial freedom.

Mainland LLCs allow you to:

- Trade anywhere in the UAE

- Work with government entities and large corporates

- Operate multiple branches

- Expand without geographical restrictions

For entrepreneurs exploring business setup in Dubai Mainland, this structure provides unmatched flexibility, credibility, and scalability.

Free Zone LLC (FZ-LLC / FZCO / FZE)

In addition to Mainland options, several UAE Free Zones offer their own version of an LLC—typically called FZ-LLC (Free Zone Limited Liability Company), FZCO (Free Zone Company), FZE (Free Zone Establishment) depending on the number of shareholders. These companies still offer the benefit of limited liability, but they are regulated exclusively by their respective Free Zone Authority, such as:

- DMCC Authority – Dubai Multi Commodities Centre

- JAFZA Authority – Jebel Ali Free Zone

- DAFZA Authority – Dubai Airport Freezone

- Meydan Free Zone – Meydan Authority

- DIFC Authority / DFSA – Dubai International Financial Centre

A Free Zone LLC is ideal for businesses that focus on international operations, e-commerce, digital businesses, consulting, tech startups, or logistics companies. They also offer:

- 100% foreign ownership

- Full profit repatriation

- No personal income tax

- Simplified setup and licensing

- Access to modern business infrastructures

However, Free Zone companies cannot conduct direct Mainland business without appointing a local distributor or obtaining additional approvals.

Main Difference in Simple Terms

If you’re planning LLC company formation in Dubai and your goal is to trade across the UAE, open retail outlets, or serve Mainland clients—then the Mainland LLC is the right choice.

If your focus is global trade, online business, or operating within a specific Free Zone ecosystem, then an FZ-LLC gives you the benefits of limited liability with simplified regulations.

Conclusion

Forming an LLC company in Dubai is a strategic step for entrepreneurs aiming to access the UAE’s thriving business ecosystem. With the right guidance, legal compliance, and strategic planning, you can establish a credible, profitable, and sustainable business in Dubai.

By following this comprehensive guide, you can navigate the LLC formation process, minimize risks, and unlock the full potential of Dubai’s market.

Don’t let complexity hold back your vision. Secure your future in Dubai today with a partner who understands your ambition.

Frequently Asked Questions

What does LLC stand for in the UAE?

LLC stands for Limited Liability Company. In the UAE, particularly in the Dubai Mainland, it is the most common legal structure for commercial and industrial businesses. This structure ensures that the shareholders’ financial liability is limited to their investment in the company’s share capital, protecting their personal assets.

Can you set up an LLC in Dubai?

Yes, you can easily set up an LLC in Dubai. Foreign investors can establish a Dubai LLC on the Mainland (regulated by the Department of Economy and Tourism – DET) or in one of the Free Zones. Crucially, recent changes allow for 100% foreign ownership of LLCs in most commercial and industrial activities on the Dubai Mainland.

What are the benefits of LLC in Dubai?

The key benefits of an LLC company formation in Dubai include:

100% Foreign Ownership: Full control over your business in most sectors (Mainland and Free Zones).

Limited Liability Protection: Personal assets are shielded from company debts.

Extensive Market Access (Mainland LLC): Ability to trade directly across the entire UAE and with government entities.

Investor Visa Eligibility: Easy application for investor and employee residency visas.

Strategic Location: Access to global markets in Asia, Africa, and Europe.

Favorable Tax Structure: Zero personal income tax and corporate tax exemptions apply to profits below AED 375,000.

Can I Open LLC in Dubai Free Zone?

How long is a trade license valid and how often must it be renewed?

Yes, you can open an LLC-equivalent structure (often called an FZ-LLC or similar, depending on the zone) in any of Dubai’s numerous Free Zones. This offers the core benefits of 100% ownership and often 0% corporate tax for qualifying companies. However, a Free Zone LLC is generally restricted to trading within the free zone and internationally; direct trade on the UAE Mainland requires a separate license or distributor.

What types of licenses can an LLC hold in Dubai?

An LLC is a flexible structure that can hold several types of licenses in Dubai, depending on its business activity:

Commercial License: For trading activities (buying and selling goods, import/export, general trading).

Professional License: For service-based activities (consultancy, accounting, legal, marketing).

Industrial License: For manufacturing, processing, and assembly activities.

Tourism License: For tourism-related services (travel agencies, tour operators).

How much does it cost to set up an LLC in Dubai?

The cost to form an LLC in Dubai varies significantly based on your jurisdiction (Mainland vs. Free Zone), business activity, office size, and number of visas.

Mainland LLC: Typically ranges from AED 12,000 to AED 30,000+ for the first-year license and registration fees, plus mandatory office space costs.

Free Zone LLC: Can start from as low as AED 6,000 for basic packages (with shared/flexi-desk options), making it generally more affordable for startups.

Do I need a local sponsor for an LLC in Dubai anymore?

No, for most business activities, you do not need a local sponsor for a Dubai Mainland LLC. Due to Federal Decree-Law No. (32) of 2021, which reformed corporate law and company registration requirements, most sectors now allow 100% foreign ownership, completely eliminating the 51% local partnership requirement for foreign investors looking at LLC company formation.

References

- Dubai Department of Economy & Tourism (DET / DED)

- UAE Ministry of Economy – Commercial Companies Law

- UAE Government Portal – Business Setup

- Dubai Municipality

- DMCC (Dubai Multi Commodities Centre) – Free Zone LLC Formation

- JAFZA (Jebel Ali Free Zone Authority)

- DIFC (Dubai International Financial Centre) – LLC & FZ-LLC Formation

- UAE Corporate Tax Portal

https://tax.gov.ae - UAE Government Business Portal

https://u.ae/en/information-and-services/business - Ministry of Economy – UAE Commercial Companies Law

- DMCC Free Zone Authority

https://www.dmcc.ae - JAFZA Free Zone

https://jafza.ae - DIFC Authority

https://www.difc.ae - Federal Tax Authority

https://tax.gov.ae

Disclaimer : This guide provides a general information . Regulations and costs may change time to time based on government rules, so consult the best solution’s professional Business Setup consultants for the latest updates. Refer to the glossary for definitions of key terms which is mentioned in this article. Refer to the glossary for definitions of key terms.