Dubai, UAE has firmly established itself as a global hub for entrepreneurs and investors from around the world. Dubai offers an unmatched environment for launching and scaling a business. Are you an entrepreneur, investor, or established business owner considering starting a business in Dubai to tap into its thriving economy and global opportunities?. The question on your mind is probably: “How complex is it to open a business bank account in Dubai, what are the exact procedures, and how long will it take?”.

At Best Solution, a leading business setup consultancy in Dubai, we understand these concerns. We specialize in transforming this seemingly complex process into a streamlined, transparent, and stress-free experience. This comprehensive guide will explain how to open a business bank account in Dubai, UAE providing you with the clarity, actionable steps, and expert insights needed for a successful setup.

Why Open a Business Bank Account in Dubai?

- Enhanced Business Credibility & Professionalism: A local corporate bank account lends significant legitimacy to your operations. It signals to clients, suppliers, and regulatory bodies like the Dubai Economy and Tourism (DET) that you are a serious, established entity.

- Access to Dubai’s Tax-Efficient Environment: While the UAE has introduced corporate tax, Dubai remains a highly attractive, low-tax jurisdiction. A local bank account is essential for managing your finances within this framework.

- Seamless Local and International Transactions: Facilitate payments to local suppliers, receive payments from UAE-based clients, and manage payroll efficiently. Many UAE banks also offer excellent international transfer services and multi-currency accounts.

- Simplified Financial Management & Accounting: Separating business finances from personal funds is crucial for accurate bookkeeping, tax reporting, and financial analysis. This clarity is vital for making informed business decisions.

- Eligibility for Business Loans & Credit Facilities: As your business grows, you may require financing. A well-maintained local business bank account with a good transaction history is often a prerequisite for accessing loans and other credit facilities from UAE banks.

- Compliance with UAE Regulations: For most business activities and license types, having a UAE-based corporate bank account is a regulatory expectation, if not a strict requirement, for operational and compliance purposes.

Why is a business bank account in Dubai important?

A business bank account in Dubai is crucial for establishing financial credibility, accessing the UAE’s tax-efficient environment, facilitating local and international transactions, simplifying accounting, and complying with local regulations. It’s a cornerstone of a legitimate business operation in the Emirates.

Who Can Open a Business Bank Account in Dubai? Understanding Eligibility

The eligibility to open a business banking account in Dubai primarily depends on your company’s legal structure and its registration authority. Generally, any legally registered entity in the UAE can apply.

- Mainland Companies (LLCs, Sole Establishments, etc.): Companies registered with the Dubai Economy and Tourism (DET) or equivalent authorities in other Emirates can open corporate bank accounts. Setting up a mainland company bank account in the UAE ensures smoother transactions and greater business credibility.

- Free Zone Companies (FZCO, FZE): Businesses established in any of Dubai’s numerous free zones (e.g., DMCC, JAFZA, DAFZA, Dubai South, IFZA) are eligible to open business bank accounts. Requirements may slightly vary depending on the specific free zone and the bank selected. Opening a bank account for Free Zone company Dubai is a critical step to ensure seamless operations, compliance, and access to local and international financial services.

- Offshore Companies (JAFZA Offshore, RAK ICC): While traditionally more challenging, some UAE banks do offer accounts for UAE-registered offshore companies, often with stricter due diligence and higher minimum balance requirements.

- Foreign Branch Offices: Branches of foreign companies registered in the UAE can also open business bank accounts.

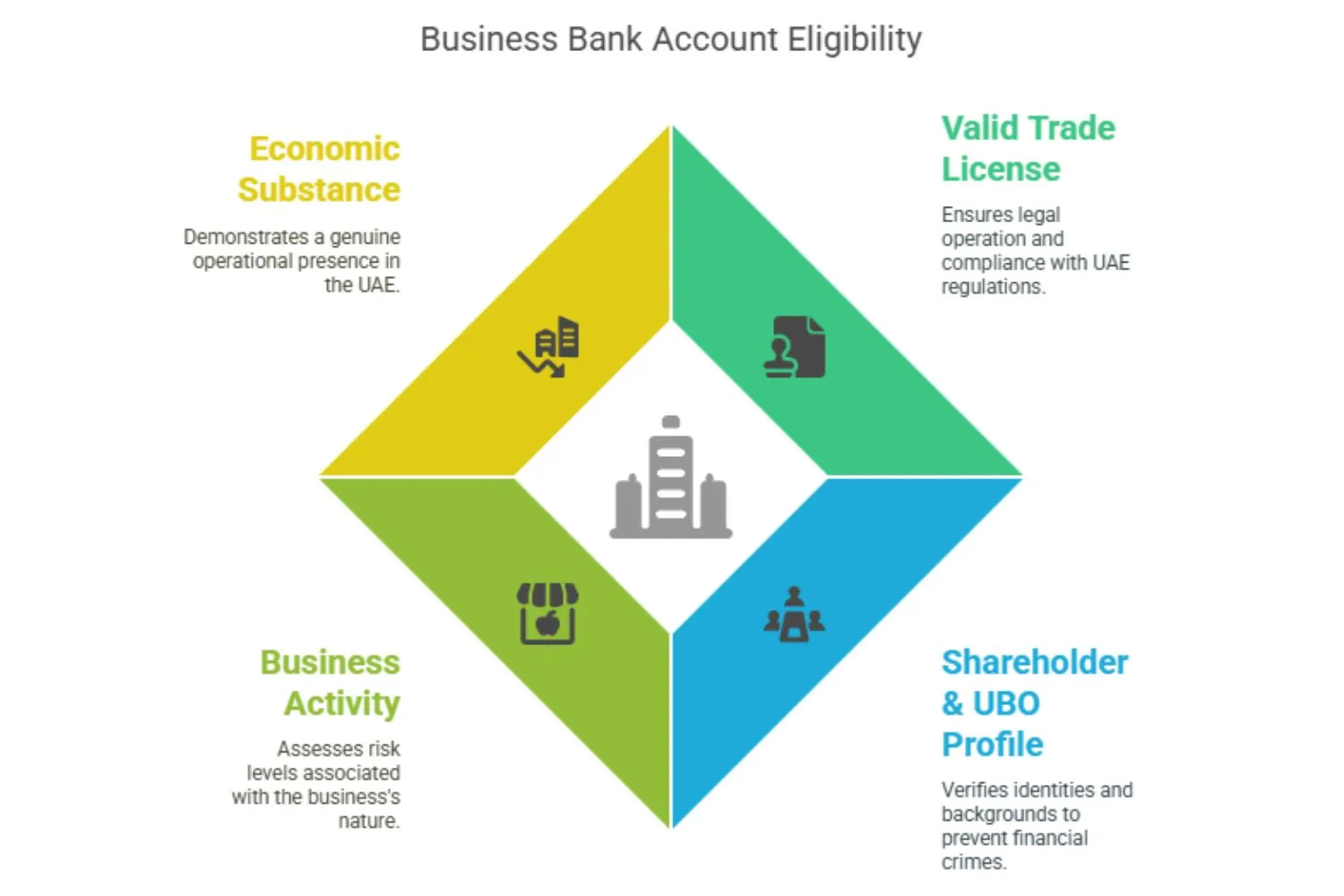

Key Considerations for Eligibility:

- Valid Trade License: This is non-negotiable. Your company must have an active trade license issued by the relevant UAE authority. Most important documents required to open a business bank account in Dubai, UAE.

- Shareholder & UBO (Ultimate Beneficial Owner) Profile: Banks conduct thorough KYC (Know Your Customer) and AML (Anti-Money Laundering) checks on all shareholders and UBOs. The nationality, residency status, and business background of these individuals can influence the application process.

- Business Activity: The nature of your business activity, as stated on your trade license, is a significant factor. Some activities are considered high-risk by banks and may face more scrutiny or even rejection.

- Economic Substance: Especially for companies aiming to benefit from certain tax advantages, demonstrating sufficient economic substance in the UAE (office space, employees, operational expenditure) is increasingly important and can positively impact bank account opening.

At Best Solution, our team of experienced business setup consultants in Dubai provides tailored advice based on your specific business structure and shareholder profile. With deep expertise in Dubai business banking, we help you navigate eligibility requirements with ease. Learn more about our comprehensive company formation services in Dubai, UAE, which often serve as the crucial first step before opening a business bank account.

What Documents are required to open a business bank account in Dubai?

Documents are typically required to open a company bank account in Dubai. While the exact list can vary from bank to bank and depend on your company’s structure and activity, a standard set of documents is generally required. Being well-prepared with these documents is key to a smoother application process.

Core Documents for Most Business Types:

- Trade License: A valid copy issued by the relevant licensing authority (e.g., DET, Free Zone Authority).

- Certificate of Registration/Incorporation: Proof of your company’s legal formation.

- Memorandum of Association (MOA) / Articles of Association (AOA): For LLCs and other corporate structures, outlining the company’s constitution and ownership.

- Share Certificate(s): Documenting the ownership structure. Passport Copies for all Shareholders and Signatories: Clear, valid copies. For non-resident shareholders, some banks may require notarized copies.

- Visa Copies and Emirates ID for UAE Resident Shareholders and Signatories: If applicable.

- Proof of Address for Shareholders and Signatories: Recent utility bill or similar document for both their country of origin and UAE residence (if applicable).

- Company Profile or Business Plan: A brief overview of your business activities, target market, expected turnover, and key suppliers/clients. This helps the bank understand your business model.

- Board Resolution: A formal document from the company’s board authorizing the opening of the bank account and appointing signatories. Banks usually provide a template.

- Office Lease Agreement (Ejari if Mainland): Proof of your company’s physical address in the UAE.

Additional Documents That May Be Requested:

- Bank Reference Letter: From a personal or corporate bank account of the shareholders, usually from their home country or country of residence.

- CVs/Profiles of Shareholders: To demonstrate their business background and experience.

- Supplier/Customer Invoices or Contracts: To substantiate business activity, especially for new companies.

- UBO Declaration: A formal declaration identifying the Ultimate Beneficial Owners of the company.

- Source of Funds Declaration: For initial capital or significant incoming transactions.

What documents are needed for a Dubai business bank account?

Key documents include a valid trade license, MOA/AOA, passport copies of shareholders/signatories, visa/Emirates ID (for residents), company profile, and a board resolution. Banks may request additional documents based on the business type and risk assessment.

Gathering these documents can be time-consuming. Best Solution’s dedicated support ensures all paperwork is correctly prepared and compiled, minimizing delays in your quest to open a business bank account in Dubai.

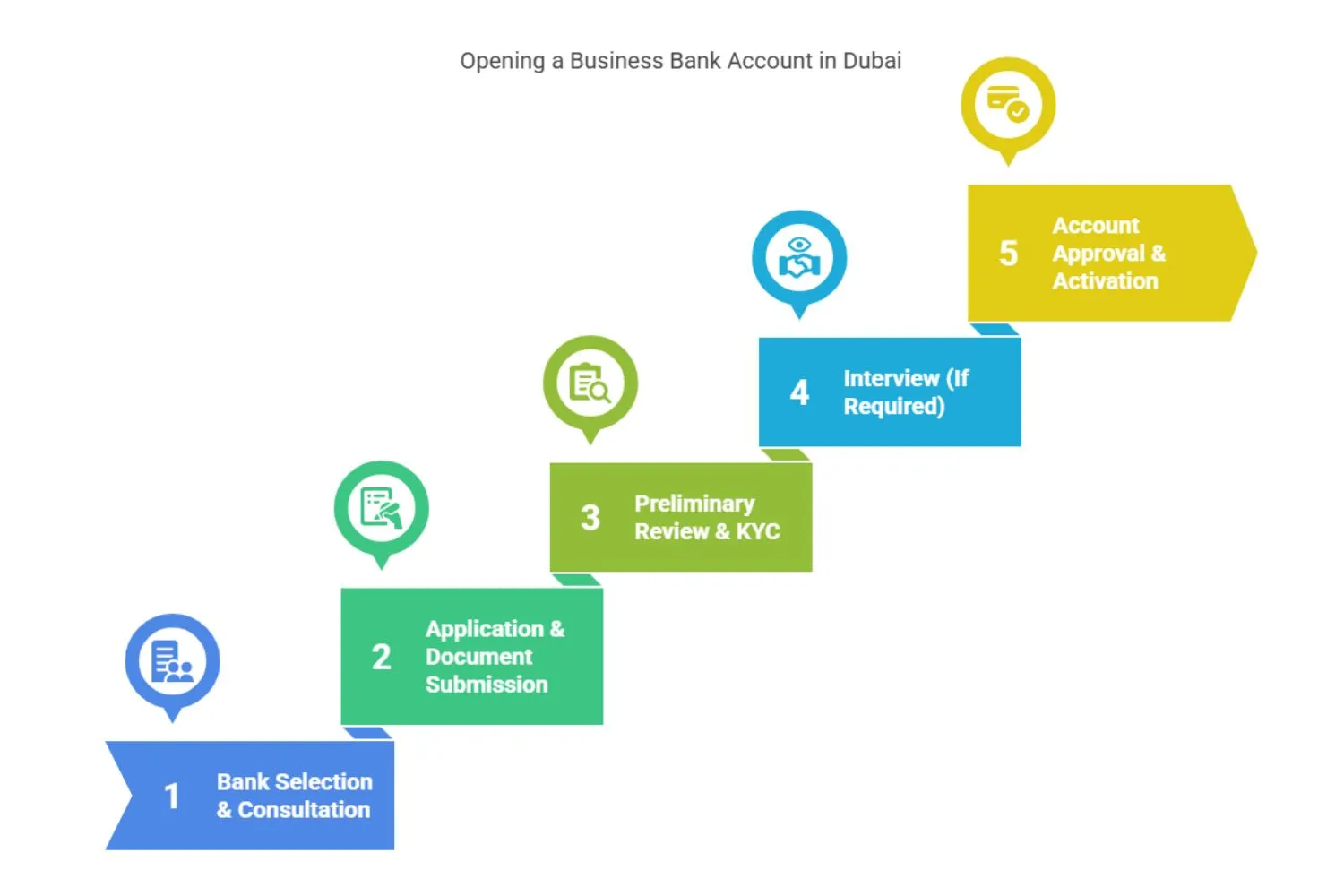

How to Open a Business Bank Account in Dubai: The Step-by-Step Process

Understanding the typical process flow can help you manage expectations and prepare effectively. While banks have their internal variations, the core stages are generally consistent.

- Research: Identify banks that align with your business needs (SME focus, international services, specific industry expertise). Consider factors like fees, online banking facilities, branch accessibility and minimum balance for business bank accounts in Dubai.

- Consultation (Recommended): This is where experts like Best Solution add immense value. With Best Solution business bank account assistance services you gain access to expert guidance tailored to your business profile. We can recommend suitable banks based on your profile and our established robust business network with various financial institutions.

Step 2: Application Form & Document Submission

- Complete the Application: Fill out the bank’s corporate account opening form accurately and completely.

- Compile Documents: Gather all required documents as per the bank’s checklist (see previous section). Ensure all copies are clear and any required attestations are done.

- Submission: Submit the application form along with all supporting documents to the bank. Some banks may allow initial submission online, but physical verification of originals is usually required.

Step 3: Preliminary Review & KYC/Due Diligence by the Bank

- Initial Check: The bank will conduct a preliminary review to ensure the application is complete and all basic documents are present.

- KYC & AML Checks: This is the most critical and often time-consuming stage. The bank will perform thorough due diligence on the company, its shareholders, UBOs, and the nature of the business. This involves verifying identities, checking against international watchlists, and assessing the risk profile.

- Queries & Additional Information: The bank may come back with queries or requests for additional documents or clarifications during this stage. Prompt and accurate responses are crucial.

- Some banks may require an in-person or video call interview with the account signatories or key shareholders, especially for new businesses or complex structures. This is to further understand the business and verify information.

Step 5: Account Approval & Activation

- Approval: Once due diligence is successfully completed and the bank is satisfied, they will approve the account opening.

- Account Details: You will receive your IBAN (International Bank Account Number), account number, and details for online banking.

- Initial Deposit: Most banks require an initial deposit to activate the account. The amount varies.

- Welcome Kit: You’ll receive your cheque book, debit/credit cards (if applied for), and any security tokens for online banking.

The journey to open a business bank account in Dubai requires patience and meticulous preparation. Best Solution’s swift service philosophy aims to expedite this by ensuring your application is robust from the outset.

Where to Open Your Account: Choosing the Right Bank in Dubai

Dubai boasts a diverse banking sector, with a mix of local UAE banks and international banks having a strong presence. When it comes to choosing the best banks for business in Dubai, it is subjective and depends entirely on your business’s specific needs and circumstances.

- Local UAE Banks: (e.g., Emirates NBD, Mashreq Bank, Dubai Islamic Bank, Abu Dhabi Commercial Bank (ADCB)). Often have a wider branch network, deep understanding of the local market, and may be more accommodating to SMEs.

- International Banks: (e.g., HSBC, Standard Chartered, Citibank). Offer strong global networks, which can be beneficial for businesses with significant international trade. May have higher minimum balance requirements or stricter criteria.

- Minimum Balance Requirements: This varies significantly. Some banks offer accounts with low or no minimum balance, while others require substantial amounts (especially for premium services or non-resident owned companies).

- Account Fees & Charges: Compare fees for account maintenance, local and international transfers, cheque book issuance, ATM withdrawals, etc. Best Solution advocates for fixed pricing and transparency, and we help you understand these costs.

- Online Banking & Digital Services: A robust and user-friendly online banking platform is essential for modern businesses. Look for features like mobile banking, bulk payment options, and trade finance portals.

- Relationship Manager & Support: Access to a dedicated relationship manager can be invaluable, especially for complex banking needs.

Specific Services Required:

- Multi-currency accounts

- Trade finance facilities (Letters of Credit, Guarantees)

- Payment gateway integration

- Corporate credit cards

- Loan and overdraft facilities

- Industry Specialization: Some banks have more experience or specialized products for certain industries (e.g., trade, real estate, technology).

- Islamic Banking: If Sharia-compliant banking is a preference or requirement, Dubai has excellent Islamic banks (e.g., Dubai Islamic Bank, Emirates Islamic) and Islamic windows in conventional banks.

What's the best bank for business accounts in Dubai?

The best bank depends on your business needs. Consider local banks like Emirates NBD or Mashreq for SME focus, or international banks like HSBC for global reach. Evaluate minimum balance, fees, online services, and specific industry requirements before deciding.

Our team at Best Solution can provide insights into which banks are currently most receptive to businesses like yours, leveraging our experience and robust business network.

When Can You Expect Your Business Bank Account to Be Active? Understanding Timelines

Typical Timeline Range:

- Optimistic Scenario: 2-4 weeks (for straightforward applications with well-prepared documentation, resident shareholders, and low-risk business activity, with a proactive bank).

- Average Scenario: 4-8 weeks (most common timeframe, allowing for standard due diligence).

- Complex Scenario: 8-12 weeks or even longer (for complex ownership structures, high-risk activities, non-resident shareholders from certain jurisdictions, or if the bank requests extensive additional information).

- Bank’s Internal Processes & Workload: Some banks are faster than others. Current application volumes can also impact speed.

- Completeness and Accuracy of Application: Incomplete or inaccurate applications are a major cause of delays.

- Shareholder Nationality & Residency: Applications involving shareholders from high-risk jurisdictions or complex UBO structures may undergo more extensive scrutiny.

- Nature of Business Activity: Certain business activities (e.g., general trading with diverse goods, financial services, crypto-related) often trigger enhanced due diligence.

- Responsiveness to Bank Queries: Promptly providing any additional information requested by the bank is crucial.

- Economic Substance: Demonstrating a tangible presence and operations in the UAE can sometimes expedite the process.

While Best Solution offers 2-day license support for company formation, corporate bank account opening operates on a different timeline dictated by the banks. However, our meticulous preparation and proactive follow-up aim to keep the process moving as efficiently as possible.

Common Challenges When Opening a Business Bank Account in Dubai

High Rejection Rates for Unprepared Applications: Banks in the UAE have stringent compliance standards. Incomplete applications or those that raise red flags during KYC are often rejected.

- Solution: Meticulous preparation of all documents, a clear business plan, and transparency. Engaging a consultant like Best Solution significantly improves application quality.

Complex Due Diligence for Certain Nationalities/Business Activities: Shareholders from certain countries or businesses in perceived high-risk sectors face heightened scrutiny.

- Solution: Full transparency, providing comprehensive supporting documentation, and potentially choosing banks with more experience in your specific sector or with your shareholder demographics.

Meeting Minimum Balance Requirements: Some banks have high minimum average balance requirements, which can be a challenge for startups.

- Solution: Research banks with lower or no minimum balance options. Best Solution can guide you to suitable choices.

Requirement for Physical Presence/Substance: Banks are increasingly wary of “shell companies.” Demonstrating genuine economic substance in the UAE (office, staff, local operations) is becoming more important.

- Solution: Secure a physical office space (even a flexi-desk initially) and plan for actual operations in the UAE. Our office solutions can assist here.

Lack of Clarity on Bank Requirements: Bank requirements can seem opaque or change without much notice.

- Solution: Work with experienced consultants who stay updated on banking policies and can provide clear communication.

Communication Gaps with Banks: Delays in responses or unclear feedback from banks can be frustrating.

- Solution: Proactive follow-up and having a consultant act as an intermediary can bridge communication gaps.

At Best Solution, we’ve seen firsthand how these challenges can derail an entrepreneur’s plans,” notes Vipin Kumar, a senior consultant at the firm. “Our role is to anticipate these hurdles and navigate them effectively for our clients, ensuring a smoother path to getting their Dubai business bank account operational.

How Best Solution Simplifies Opening Your Business Bank Account in Dubai

- Expert Guidance & Bank Selection: We assess your business profile, shareholder structure, and specific banking needs to recommend the most suitable banks. Our robust business network and up-to-date knowledge of bank preferences give you an edge.

- Meticulous Document Preparation: We guide you in compiling all necessary documents, ensuring they meet the stringent requirements of UAE banks. This minimizes the chances of rejection or delays due to incomplete paperwork.

- Application Submission & Follow-up: We assist in completing the application forms accurately and manage the submission process. We then proactively follow up with the bank on your behalf, ensuring your application stays on track.

- Clear Communication & Transparency: We believe in clear communication throughout the process. You’ll be kept informed of progress and any requirements from the bank. With Best Solution, there are no hidden charges – our fixed pricing for services is communicated upfront.

- Addressing Queries & Challenges: Should the bank raise any queries or concerns, our experienced team will help you formulate effective responses and provide any additional documentation needed.

- Dedicated Support: Each client receives dedicated support from our experienced consultants, like Essa Al Harthi, who are committed to your success. We understand the psychological intent of our clients – the need for credibility and smooth operations – and we deliver.

- Post-Account Opening Support: Our relationship doesn’t end once the account is open. We offer post-license support, including guidance on maintaining good standing with the bank and other related corporate advisory services.

Our aim is to simplify the entire journey, leveraging our customized solutions to meet your unique needs. We strive for swift service without compromising on diligence or compliance.

Ensuring Compliance and Upholding Ethical Standards

- Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF): UAE banks have robust AML/CTF frameworks in line with international standards. Full transparency regarding your business activities, source of funds, and UBOs is mandatory.

- Economic Substance Regulations (ESR): If your business conducts “Relevant Activities,” you must comply with ESR, which includes demonstrating adequate economic presence in the UAE. This can be a factor in maintaining your bank account.

- Corporate Tax Compliance: With the introduction of UAE Corporate Tax, maintaining accurate financial records and ensuring timely compliance through your business bank account is crucial.

- Data Protection: Be mindful of UAE data protection laws when handling customer and company data.

Best Solution emphasizes the importance of compliance from day one. We guide our clients on best practices to ensure their business operations and financial conduct meet the high standards expected in Dubai and the wider UAE.

Conclusion: Your Gateway to Business Success in Dubai Starts with the Right Bank Account

Opening a business bank account in Dubai is a foundational step for any entrepreneur or investor looking to capitalize on the immense opportunities this vibrant emirate offers. While the process involves careful preparation, adherence to regulatory requirements, and patience, the rewards – financial credibility, operational efficiency, and access to a thriving market – are significant.

By understanding the requirements, choosing the right banking partner, and preparing meticulously, you can navigate this process successfully. However, the complexities and dynamic nature of banking regulations mean that expert guidance can be invaluable.

Ready to Open Your Business Bank Account in Dubai with Confidence?

Don’t let the complexities of bank account opening slow down your Dubai business ambitions. The team at Best Solution is here to provide the expert assistance, customized solutions, and dedicated support you need. We simplify the process, ensuring transparency, efficiency, and compliance every step of the way.

Contact Best Solution team today for a free consultation to discuss your business bank account needs.

Let Best Solution be your trusted partner in navigating the path to successfully open a business bank account in Dubai, paving the way for your business growth and success in the UAE.

Frequently Asked Questions

Setting up a business bank account in Dubai can seem complex, especially for foreign entrepreneurs. To simplify the process, we’ve compiled answers to the most common questions — based on our experience assisting businesses of all sizes. Each answer includes a clear solution to help you move forward with confidence.

Can I open a business bank account in Dubai online?

While some initial steps or document submissions might be possible online for certain banks, the final verification, signing of documents, and KYC procedures typically require an in-person visit by at least one authorized signatory. Some banks are exploring more digital onboarding, but physical presence at some stage is common. Best Solution can advise on current bank-specific practices.

Can a foreigner open a business bank account in Dubai?

Yes, foreigners can open a business bank account in Dubai, provided they have a legally registered company in the UAE (either Mainland or Free Zone). The key is the UAE-registered entity, not just the nationality of the shareholders, though shareholder profiles are part of the due diligence.

What is the minimum balance required for a business bank account in Dubai?

Minimum balance requirements vary widely among banks. Some offer accounts with no or low minimum balances (e.g., AED 10,000 to AED 25,000), while others, especially for certain account types or international banks, may require significantly higher average monthly balances (AED 50,000 to AED 200,000 or more)

How long does it typically take to open a business bank account in Dubai?

The timeline can range from 2 weeks to 3 months, or sometimes longer. Factors include the chosen bank, completeness of documentation, complexity of the business structure, shareholder nationalities, and the bank’s internal due diligence processes.

Do I need a UAE residence visa to open a business bank account in Dubai?

While having a UAE residence visa for at least one signatory can simplify and expedite the process with many banks, it’s not always a strict prerequisite for all shareholders. However, banks generally prefer at least one signatory to be a UAE resident. Non-resident account opening is possible but often involves more scrutiny and potentially higher minimum balance requirements. Best Solution’s visa services can be helpful here.

Disclaimer : This guide provides a general information. Regulations and costs may change time to time based on government rules, so consult the best solution’s professional Business Setup consultants for the latest updates. Refer to the glossary for definitions of key terms which is mentioned in this article. Refer to the glossary for definitions of key terms. Refer to the glossary for definitions of key terms.