In the fast-moving world of UAE business, where compliance and credibility define your growth, the Tax Registration Number (TRN) is more than just a formality — it’s your legal identity in the VAT ecosystem. Whether you’re invoicing clients, reclaiming input tax, or verifying a partner’s legitimacy, knowing how to validate a TRN can protect your business from financial and legal setbacks.

As a leading business setup consultancy in Dubai, Best Solution understands the concerns business owners face when dealing with TRN-related issues. We’ve seen firsthand how unclear or invalid TRNs can disrupt transactions, delay tax filings, and create compliance risks — even for well-established companies. That’s why we’ve created this guide to clarify everything you need to know. In this guide, we’ll answer these questions and more. You’ll learn: What TRN means and why it matters in the UAE, Step-by-step how to check its validity of TRN, How to apply for a TRN, What to do if you encounter an invalid or suspicious TRN etc.

Whether you’re starting a business in Dubai, UAE, closing a deal, or just making sure you’re on the right side of UAE tax law — this blog is your clear, practical roadmap to understanding and verifying TRNs in the UAE.

What is a Tax Registration Number in the UAE?

Before diving into how to check TRN validity in UAE, let’s establish a clear understanding of what a TRN actually is.

A Tax Registration Number (TRN) is a unique 15-digit identification number issued by the Federal Tax Authority (FTA) in the United Arab Emirates. Its primary purpose is to identify businesses and individuals registered for tax purposes within the UAE. This number is essential for all tax-related transactions, filings, and communications with the FTA.

The TRN is exclusively issued by the Federal Tax Authority (FTA), the government entity responsible for administering, collecting, and enforcing federal taxes in the UAE.

Initially, the TRN was predominantly associated with Value Added Tax (VAT), which was introduced in the UAE on January 1, 2018. Businesses meeting specific revenue thresholds are required to register for VAT and obtain a TRN. More recently, with the introduction of UAE Corporate Tax (CT) effective for financial years starting on or after June 1, 2023, the TRN’s scope has expanded. Most businesses subject to Corporate Tax will also need to register with the FTA and will use their TRN for CT purposes. It’s important to note that a single TRN will typically cover all tax obligations (like VAT and CT) for a registered entity.

Understanding the TRN is the first step. For businesses aiming for a seamless launch, services like our business registration in Dubai, UAE ensure all foundational elements, including tax considerations, are addressed from day one.

The Importance of TRN in UAE

In the UAE’s highly regulated, tax-compliant business environment, the Tax Registration Number (TRN) isn’t just a number — it’s a legal backbone for any VAT-registered entity. Issued by the Federal Tax Authority (FTA), your TRN proves that your business is authorized to collect and remit VAT, file returns, and operate transparently within the UAE economy. For investors and business owners, a valid TRN builds trust with clients, vendors, and government authorities — and protects you from costly errors, audits, or penalties. In a market where reputation matters, a verified TRN signals credibility, compliance, and operational readiness.

How to Check TRN Validity in UAE: A Step-by-Step Guide

Verifying the TRN validity in UAE is a straightforward process, thanks to the online tool provided by the Federal Tax Authority (FTA). This is the most reliable method to ensure the TRN you’re checking is legitimate.

- The Official Method: Using the FTA Portal. The FTA website is the definitive source for TRN verification.

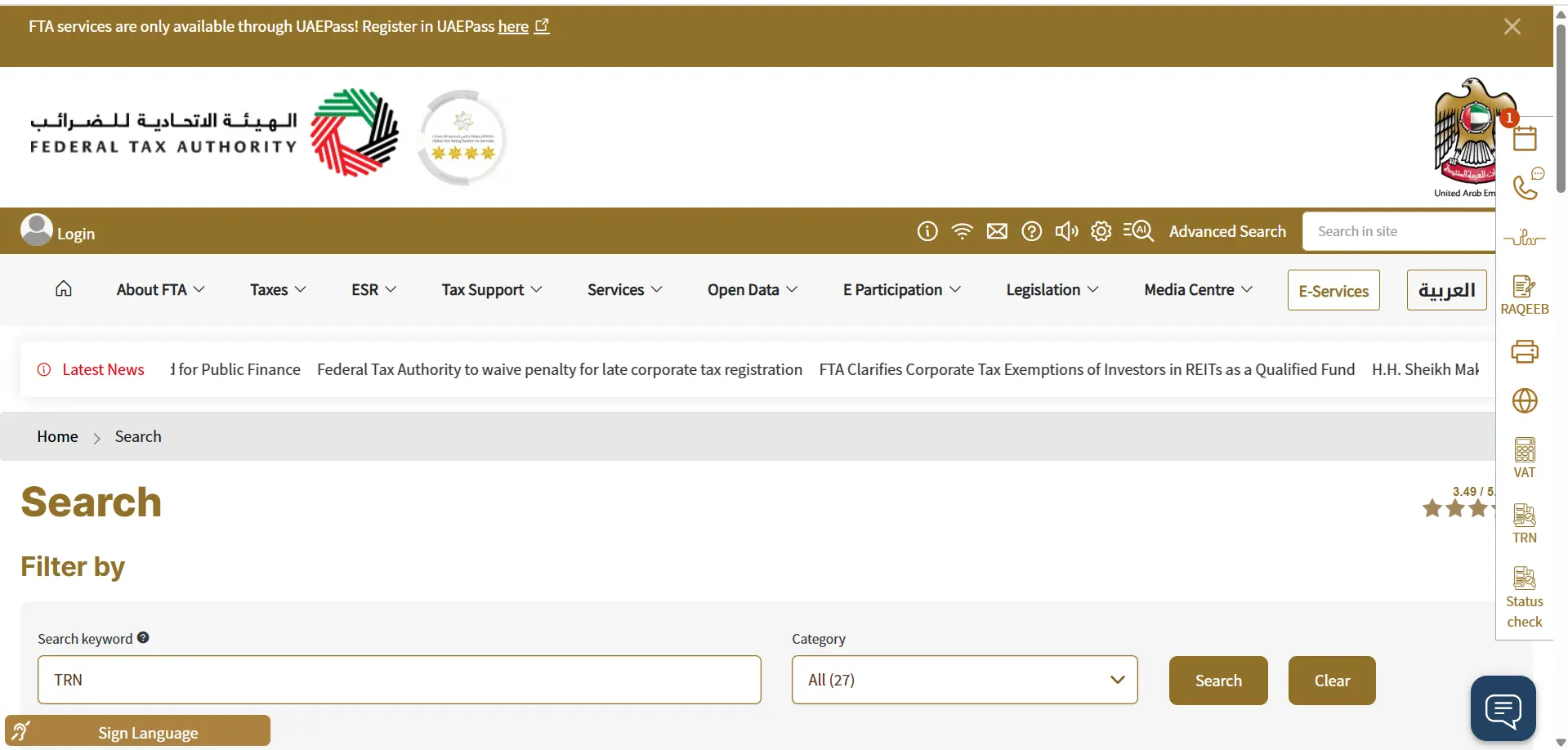

- Accessing the FTA Portal: Open your web browser and navigate to the official FTA website. You can typically find this by searching “Federal Tax Authority UAE” or going directly to tax.gov.ae.

- Navigating to the TRN Verification Tool: On the FTA homepage, look for a section or link related to “TRN Verification,” “Verify TRN,” or “TRN Lookup.” It’s often found under e-services or a public services section. The direct path is usually by navigating to a dedicated page for TRN verification.

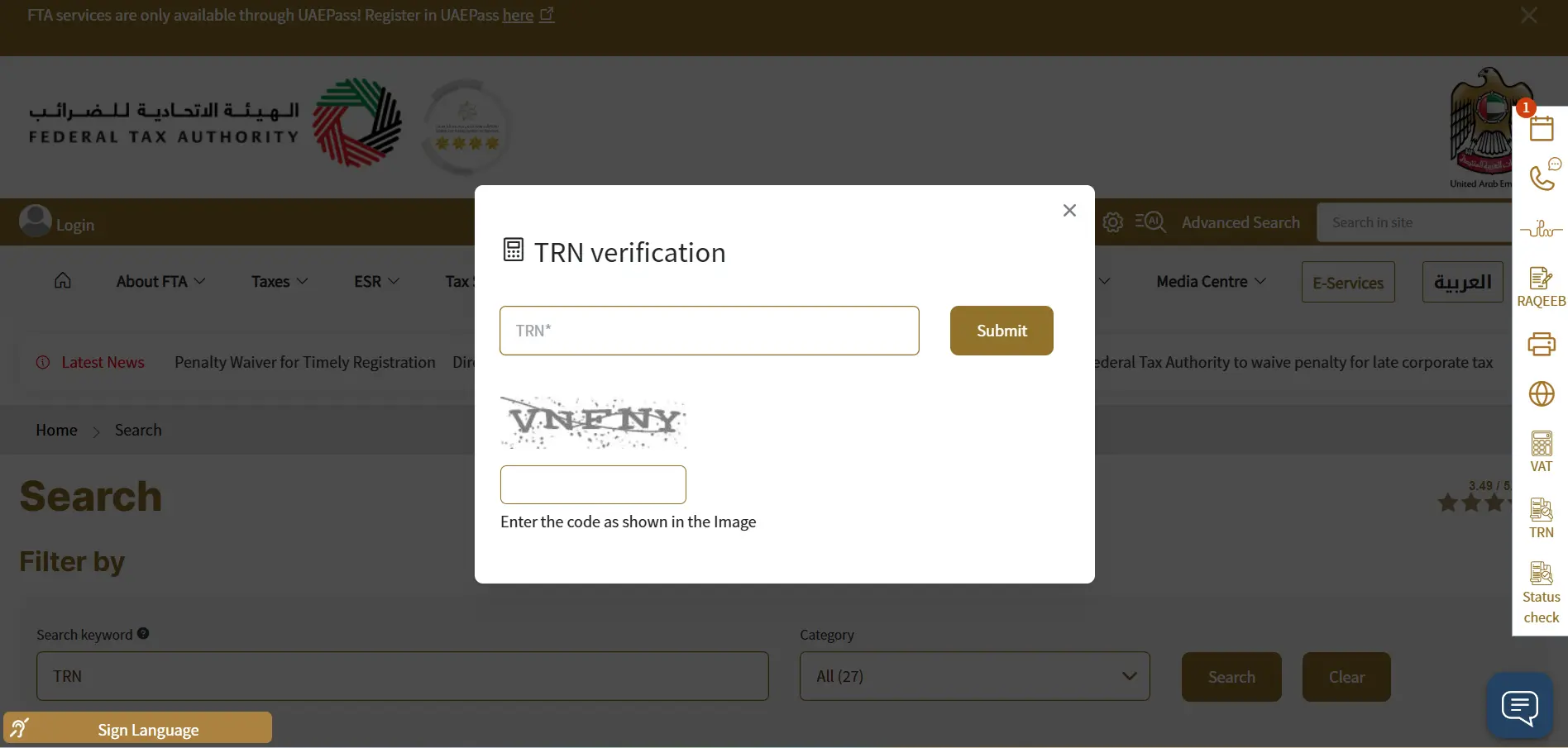

- Entering the TRN: Once you’re on the TRN verification page, you’ll see a field where you need to enter the 15-digit Tax Registration Number you wish to check. Enter the number carefully, ensuring there are no typos.

- Security Check/CAPTCHA: You will likely need to complete a security check, such as a CAPTCHA, to prove you’re not a bot.

- Valid TRN: If the TRN is valid, the system will typically display the legal name of the business (in English and Arabic) associated with that TRN. This confirms the TRN is active and registered with the FTA.

- Invalid TRN / TRN Not Found: If the TRN is incorrect, does not exist, or belongs to a deregistered entity, the portal will indicate that the TRN is not valid or cannot be found.

What Information is Displayed Upon Successful Verification?

A successful verification will usually show:

- The Tax Registration Number itself.

- The Legal Name of the Registrant (the company or individual). This allows you to cross-reference the TRN with the company name you have on record.

Common Issues and Troubleshooting:

- Typos: The most common issue is an incorrect TRN entry. Double-check the 15-digit number.

- System Delays: Occasionally, the FTA portal might experience high traffic or undergo maintenance. If you encounter issues, try again after some time.

- Recently Issued TRNs: If a TRN has been very recently issued, there might be a slight delay before it appears in the public verification tool.

- Browser Issues: Try clearing your browser cache or using a different browser if the page doesn’t load correctly.

How can I check a TRN number in UAE?

You can check a TRN number in the UAE by visiting the official Federal Tax Authority (FTA) website. Navigate to their TRN verification tool, enter the 15-digit TRN, complete the security check, and the system will display the company’s legal name if the TRN is valid.

This verification is a key part of financial due diligence. For comprehensive support, including assistance with Bank Account Opening in Dubai, ensuring all your financial groundwork is solid, Best Solution is here to help.

Why is TRN Validity Crucial for Your Business in the UAE?

Verifying the TRN validity in UAE isn’t just a procedural formality; it’s a cornerstone of prudent business practice. For businessmen, investors, and anyone operating or planning to start a business in Dubai, understanding its importance can save significant time, money, and potential legal headaches.

- Ensuring Legal Compliance (VAT and Corporate Tax): A valid TRN on every invoice keeps you in line with UAE VAT & Corporate Tax rules and shields you from FTA penalties.

- Building Trust with Suppliers and Customers: Showing (and checking) a real TRN proves you and your suppliers are bona-fide, tax-registered entities—boosting trust on both sides of every deal.

- Penalty Protection

Verifying TRNs before you transact helps you sidestep fines for filing errors or doing business with non-compliant partners. - Cash-Flow Friendly

Only a valid supplier TRN lets you reclaim input VAT; pay an invalid TRN and that money is gone from your bottom line. - Reputation Builder

Due-diligence checks signal professionalism to investors, banks, and the market—crucial for startups and foreign entrants. - Fraud & Risk Guard

A quick TRN lookup before large payments slashes the chance of being caught in a scam or fraudulent tax scheme.

At Best Solution, we emphasize these checks as part of our comprehensive Corporate Tax Advisory Services in UAE, ensuring our clients operate with full transparency and compliance.

Who Needs a TRN in the UAE?

Understanding who is required to have a TRN is essential for anyone doing business in the Emirates. The requirement isn’t universal for every single business activity from day one, but the scope is broad, especially with the advent of Corporate Tax.

- Mandatory VAT Registration

Businesses must register for VAT and get a TRN if their taxable turnover exceeds AED 375,000 in the past 12 months or is expected to in the next 30 days. - Voluntary VAT Registration

If your taxable turnover (or expenses) is above AED 187,500, you can voluntarily register — useful if you deal with VAT-registered businesses and want to claim input VAT. - Corporate Tax Registration

Most UAE businesses — including mainland companies, free zone entities, and individuals with a business activity — are now required to register for Corporate Tax, which uses the same TRN. - Misconception Alert

TRNs aren’t just for large corporations. Even small businesses and startups may need one under VAT or Corporate Tax laws.

💡Unsure if your business qualifies? At Best Solution, we help you assess eligibility and handle VAT and Corporate Tax registrations swiftly — so you stay compliant and stress-free.

Do all small businesses in UAE need a TRN?

Not all small businesses immediately need a TRN for VAT if their turnover is below AED 375,000. However, most businesses, regardless of size, will likely need to register for Corporate Tax and obtain/use a TRN.

If you’re unsure whether your business requires a TRN, our experts at Best Solution can provide clear guidance. We offer VAT Registration Services in UAE and comprehensive advice on Corporate Tax obligations, ensuring you meet all FTA requirements with our swift service and dedicated support.

What if a TRN is Invalid or Cannot be Verified?

- Incorrect Number: The simplest reason could be a typographical error when the TRN was provided to you or when you entered it into the FTA portal. Always double-check.

- Fake or Fraudulent TRN: Unfortunately, some entities might provide a fake TRN to appear legitimate or to evade taxes.

- Deregistered Company: The company might have previously been registered for tax but has since deregistered with the FTA (e.g., due to cessation of business or falling below the mandatory registration threshold).

- TRN Not Yet Active: In rare cases of very new registrations, there might be a slight lag before the TRN becomes publicly verifiable.

- System Error: While uncommon, technical glitches on the portal could temporarily prevent verification.

Steps to Take if a Supplier's TRN is Invalid:

- Do Not Proceed with Payment (if VAT is involved): If you are about to make a payment based on a tax invoice showing VAT, and the supplier’s TRN is invalid, do not pay the VAT amount until the issue is clarified. You may not be able to reclaim this VAT if the supplier is not genuinely registered.

- Communicate with the Supplier: Politely inform the supplier that you were unable to verify their TRN on the FTA portal. Request them to confirm the TRN and provide a copy of their TRN certificate. It could be a simple misunderstanding or typo.

- Request TRN Certificate in UAE: Ask the supplier to provide a copy of their official TRN certificate issued by the FTA. This document will confirm their registration status and correct TRN.

- Re-verify: Once they provide the confirmed TRN or certificate, try verifying it again on the FTA portal.

- Exercise Caution: If the supplier is uncooperative or unable to provide a valid TRN or satisfactory explanation, it’s a significant red flag. You should reconsider doing business with them, especially if substantial amounts are involved.

Consequences of Dealing with Entities with Invalid TRNs:

- Inability to Reclaim Input VAT: If you pay VAT to an entity with an invalid TRN, the FTA will likely disallow your claim for input tax credit on that transaction. This means a direct financial loss for your business.

- Risk of Involvement in Tax Evasion Schemes: Knowingly or unknowingly participating in transactions with entities using fake TRNs can draw scrutiny from the FTA and potentially implicate your business.

- Damage to Business Relationships: If you issue an invoice with an invalid TRN, your customers won’t be able to claim their input tax, damaging your credibility.

Real Case: How Best Solution Resolved a TRN Verification Issue

With over 10 years of hands-on experience in UAE compliance and FTA processes, our team acted quickly:

- We cross-checked the TRN against the FTA’s official records and found it had been deregistered due to non-compliance.

- We contacted the supplier directly and requested updated documentation — they were unable to provide valid tax proof.

- We advised our client to halt the transaction, avoiding a potential VAT claim rejection and financial loss.

- We helped them identify a reliable, FTA-verified supplier from our trusted network to ensure business continuity.

Our thorough investigation and quick response, the client avoided a bad deal and protected their VAT position. At Best Solution, we don’t just register companies — we protect them. If you ever doubt a TRN or face a compliance issue, our experts are here to support you with clarity, speed, and full legal assurance.

Conclusion: Secure Your Business with Diligent TRN Verification and Expert Guidance

Verifying TRN validity in UAE is more than just a box-ticking exercise; it’s a fundamental practice for any prudent businessman, investor, or entrepreneur operating in this dynamic region. It underpins your legal compliance, safeguards your financial transactions, builds trust with your partners, and protects your hard-earned business reputation. As we’ve explored, the process itself is straightforward via the FTA portal, but the implications of neglecting this step can be significant.

From understanding what a TRN is and why it matters, to knowing who needs one and how to check its validity, this guide has aimed to provide you with the clarity and confidence to navigate this aspect of UAE business. Furthermore, recognizing the steps to take when a TRN is invalid and understanding the process of obtaining your own TRN are crucial for seamless operations.

At Best Solution, we echo the sentiments of our Senior Business Setup Consultant, Essa Al Harthi, who emphasizes that “Transparency and due diligence in all financial and regulatory matters, including TRN verification, are the bedrock of sustainable business success in the UAE.”

Ready to make your business fully compliant and secure in the UAE? Whether you need help verifying a TRN, applying for one, or navigating VAT and Corporate Tax regulations, Best Solution is here to guide you. With customized solutions, fixed pricing, swift service, and dedicated support, we ensure a smooth, transparent setup journey. Don’t let tax or compliance confusion put your venture at risk. Contact Best Solution today for a free consultation, and let our experts simplify the process while you focus on growing your business.

Frequently Asked Questions

What do I do if a supplier's TRN is invalid in UAE?

If a supplier’s TRN is invalid, avoid processing the transaction and do not claim input VAT on that invoice. Contact the supplier for clarification, and if issues persist, report it to the Federal Tax Authority (FTA) for further investigation.

What's the difference between a TRN and a Trade License number?

A Trade License number is issued by the relevant Emirate’s economic department (e.g., Dubai Economy and Tourism – DET) and permits you to conduct specific business activities. A TRN is issued by the Federal Tax Authority (FTA) for tax purposes (VAT and Corporate Tax). Both are essential but serve different regulatory functions.

What happens if I don't register for a TRN when required?

Failure to register for a TRN with the FTA when your business meets the mandatory registration criteria (for VAT or Corporate Tax) can lead to significant administrative penalties, late registration fines, and potential legal complications.

Can an individual have a TRN?

Yes, individuals (natural persons) conducting a business or business activity in the UAE that makes them subject to VAT or Corporate Tax may also be required to obtain a TRN.

Why is checking TRN validity important?

Checking TRN validity is crucial for ensuring legal compliance with UAE tax laws, avoiding penalties from the Federal Tax Authority, and maintaining accurate tax records for both VAT and Corporate Tax.

Disclaimer : This guide provides a general information . Regulations and costs may change time to time based on government rules, so consult the best solution’s professional Business Setup consultants for the latest updates. Refer to the glossary for definitions of key terms which is mentioned in this article. Refer to the glossary for definitions of key terms. Refer to the glossary for definitions of key terms.