Starting a business in a vibrant hub like Dubai is incredibly exciting! But before you launch your amazing idea, there’s one crucial step you absolutely can’t skip: getting the right trade license in Dubai. Think of it as your official permission slip to operate legally and thrive in this dynamic economy.

Choosing the correct type of trade license is the foundation of your entire operation, affecting everything from your business activities to your ownership structure. So, let’s dive into the core types of trade licenses in Dubai and figure out which one is the perfect fit for your venture.

Trade License in Dubai

A trade license in Dubai is a mandatory legal document issued by the Department of Economy and Tourism (DET) or a Free Zone Authority that grants an individual or business the official right to conduct specific commercial, professional, or industrial activities within the Emirate.

Essentially, it serves as the foundational permission slip that legalizes your business operations, defining your scope of work, your entity’s structure, and ensuring compliance with local government regulations, which is critical for everything from signing contracts to opening a corporate bank account.

A recent survey of 500 expatriate entrepreneurs conducted by Best Solution Business Setup consultancy in Dubai, found that 83% identified “Choosing the correct type of trade license” as the single most confusing step in their entire Dubai business setup process, ranking it ahead of finding office space and opening a corporate bank account. This highlights the critical necessity of getting the foundation right from the start.

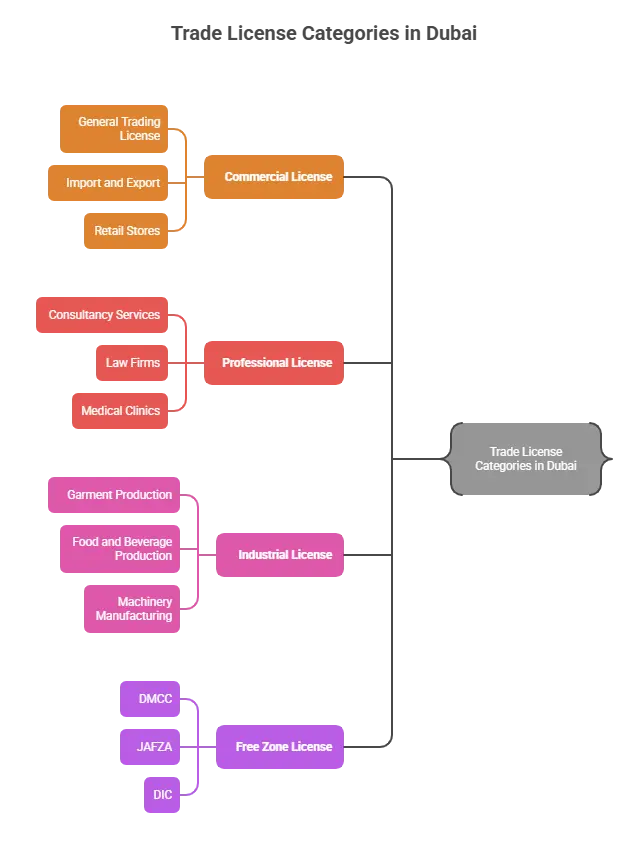

The Core Types of Trade License in Dubai

While there are many specific categories, most business activities in Dubai fall into one of three primary trade license categories in Dubai, issued by the Department of Economy and Tourism (DET):

1. Commercial License (For Trading)

What it’s for:

This is the go-to license for any business involved in buying and selling goods. If your business deals with commodities, products, or physical items, this is likely your category.

- Key Activities:

- General Trading License: A flexible option that allows you to trade in a wide range of products.

- Import and Export

- Retail stores and wholesale

- Car rental services and logistics

- Best for: Companies trading in electronics, clothing, foodstuff, automobiles, or engaging in general import/export activities.

2. Professional License (For Services & Skills)

- What It’s For: Designed for individuals or companies that offer intellectual services or rely on a specific professional skill, expertise, or talent.

- Key Activities:

- Consultancy services (Management, IT, Marketing, Tax)

- Law firms and Auditing services

- Medical clinics and Healthcare services

- Educational institutions

- Beauty salons and repair services

- Major Benefit (Mainland):

- You can often enjoy 100% foreign ownership.

- While a Local Service Agent (LSA) may be required, the LSA has no ownership or operational control over the company.

- The LSA is compensated via a fixed annual fee, thus preserving 100% foreign control for the investor.

- Best For: Consultants, doctors, engineers, lawyers, accountants, and IT specialists.

3. Industrial License (For Manufacturing)

- What it’s for: If your business is involved in manufacturing, processing, or producing goods, you need an industrial license. This means physically transforming raw materials into finished products.

- Key Activities:

- Garment production and textile manufacturing

- Food and beverage production

- Machinery and equipment manufacturing

- Oil, gas, and chemical manufacturing

- Requirement: An industrial license typically requires a physical office or warehouse in a designated industrial area or free zone.

- Best for: Factories, production units, and any business adding value to raw materials.

4.Free Zone License:

- What it’s for: Offers 100% foreign ownership, 100% profit repatriation, and historically, 0% Corporate Tax (subject to meeting “Qualifying Free Zone Person” criteria under the new UAE Corporate Tax law).

- Key Activity: Can be commercial, professional, or industrial, but is issued by a specific Free Zone Authority (e.g., DMCC, JAFZA, DIC).

Distinction: A Free Zone company is legally distinct from a Mainland Company (which holds the DET-issued Commercial, Professional, or Industrial licenses) and has limitations on directly trading in the local Mainland market.

Specialized and Emerging License Types

Dubai’s economy is incredibly diverse, so beyond the big three, there are also specialized licenses tailored for specific needs:

- Tourism License: Essential for businesses in the hospitality and travel sector, such as tour operators, travel agencies, and hotel rentals.

- E-Commerce License (e-commerce license in Dubai): E- commerce license is perfect for entrepreneurs selling products or services online. This is especially popular for startups leveraging the digital marketplace.

- Freelance Permit: A straightforward and affordable option for sole professionals (like freelancers, consultants, or media specialists) who want to work from a free zone.

- General Trading License: As mentioned, this is a flexible commercial license allowing for the trade of multiple, non-restricted items. It’s often the ideal choice for diversified businesses.

Beyond the Basics: Modern License Decisions in the UAE

The landscape for business setup in Dubai is constantly evolving. A truly informed decision on your type of trade license in Dubai must now account for two major modern considerations: the new corporate tax regime and the specific free zone ecosystem best suited for your activity.

Grounded Evidence: According to recent data from the Department of Economy and Tourism (DET), new business licenses issued in Dubai increased by over 20% in the first half of 2024 compared to the previous year, highlighting the sustained boom and the urgency of choosing the right license structure now.

1. The Corporate Tax Factor: Mainland vs. Free Zone Re-evaluation

The introduction of the UAE Corporate Tax (CT), effective for financial years starting on or after June 1, 2023, has added a crucial layer to the Mainland vs. Free Zone debate.

- Mainland (DET) Licenses: These companies are subject to the standard 9% corporate tax rate on all taxable income exceeding AED 375,000. However, most Small and Medium Enterprises (SMEs) fall under the 0% tax bracket for income below this threshold, which remains a huge draw for local market businesses.

- Free Zone Licenses (The ‘Qualifying Free Zone Person’): Free Zone company in Dubai, can still benefit from a 0% corporate tax rate on their Qualifying Income.1 This 0% rate is not automatic; it requires the company to meet strict conditions, including maintaining adequate substance (physical presence, staff, expenditure) and ensuring they only derive Qualifying Income (often revenue from transactions within the same free zone or with foreign entities). If they transact significantly with the UAE Mainland, they may lose their “Qualifying” status and face the 9% tax.

Key Insight: The CT forces businesses focused on the local Mainland market to weigh the 9% tax rate against the advantage of unlimited local trading, while Free Zone companies must now carefully structure their Mainland transactions (Non-Qualifying Income) to remain eligible for the 0% benefit.

2. Choosing Your Hub: The Most Popular Free Zones by License Type

Free zones are no longer generic. They are specialized business ecosystems aligned with specific trade license categories. Choosing the right zone is as critical as choosing the right license type.

| License Type | Ideal Activity | Suggested Top Free Zones & Why |

| Commercial (Trading) | Logistics, Import/Export, General Trading, E-commerce | JAFZA: Global logistics hub with massive infrastructure and port access.

Dubai CommerCity: Best for pure e-commerce, digital trade & fulfillment. |

| Professional (Service / Consultancy) | Marketing, IT, Media, Consulting, Fintech, Digital Services | DMCC: World's #1 Free Zone for professional services & global trade.

DIC: Ideal for tech, digital media, IT consultancy & SaaS. |

| Industrial (Manufacturing) | Heavy/Light Production, Assembly, Fabrication | JAFZA: Massive industrial areas + proximity to port + integrated customs.

Dubai Industrial City (DIC): Purpose-built factories & industrial ecosystem. |

3. Expert Scenario: The Complexities of a Multi-Activity License

Imagine setting up a “Smart Health Kiosk” company in Dubai. This requires multiple activities that cross categories, demanding a meticulously structured license:

| Factor | License Type | Approvals Required |

| Retail Sale of Vitamins & Supplements | Commercial License | DET (Mainland) or relevant Free Zone authority |

| Health & Nutrition Consultancy | Professional License | DET (Mainland) or Free Zone Authority |

| Sale of Medical Diagnostic Devices | Commercial License | DHA Approval Required |

| Software Development (for Kiosk App) | Professional License | Regulated by zone authority (e.g., DIC or TECOM) |

The Challenge: A single company cannot usually combine a Professional and Commercial license category on the Mainland, or it may require a mixed-activity license which is complex. The Solution is often to choose the primary activity’s license type and ensure the secondary activities are permissible sub-activities under the same authority, or to establish two distinct Free Zone entities (one Commercial, one Professional) under the same holding structure.

How to Choose the Right Trade License

Choosing the right business license in Dubai boils down to answering two simple questions:

- What is my core business activity? (e.g., Am I selling a product, providing a service, or manufacturing?)

- Where do I want to operate and trade? (e.g., Do I need to sell directly to customers across all of Dubai/UAE, or am I focused on international/online sales?)

Getting this right from the start is vital, as operating without a valid license or with the wrong license can lead to fines and legal complications.

Common License Selection Error: Mixing Services and Trading

One of the most frequent and costly mistakes first-time entrepreneurs make in Dubai is underestimating their operational needs by attempting to combine fundamentally different activities under a single, incorrect license.

The Core Conflict: Professional vs. Commercial

Professional License (Services): Is for selling skills, advice, or expertise (e.g., consultancy, legal services, IT support).

Commercial License (Trading): Is for selling tangible goods or products (e.g., retail, import/export, physical commodities).

The Mistake: A common error is a consultant (who needs a Professional License) attempting to sell packaged goods, software, or digital products (which requires a Commercial activity) without realizing the authorities view these as separate categories.

The Consequence: This oversight often leads to a mandatory license amendment, a delay in launch (typically 10–14 days), and unexpected additional costs that can range from AED 15,000 to AED 25,000 for restructuring and re-approvals.

“The Professional vs. Commercial conflict is the single most common speedbump we see. Entrepreneurs must think about their checkout cart, not just their service offering. If anything is sold as a product—even a software license or a packaged report—it needs to be legally recognized. We always advise clients to structure their activities in a way that minimizes future amendments, a core commitment to efficiency we uphold at Best Solution.”- Vipin Kumar, General Manager, Best Solution Business Setup Consultancy

The Fix: Always clarify your primary and secondary activities upfront with a specialist. If you offer a service and sell a product, you may require a specialized mixed-activity license or be advised to set up two distinct entities (one Professional, one Commercial) to maintain legal compliance.

Ready to Take the Leap?

Dubai’s pro-business environment and streamlined licensing process make it one of the most attractive places in the world to start a company. By understanding the core types of trade licenses in Dubai—Commercial, Professional, and Industrial—and clarifying your jurisdiction, you’re already halfway there!

Do you have a specific business activity in mind, or are you wondering whether a Professional or Commercial license would be better for your firm?

Frequently Asked Questions

What are the main types of trade license in Dubai?

The three primary types are Commercial (trading goods), Professional (services & skills), Industrial (manufacturing/production) and freezone lincense.

Who issues trade licenses in Dubai and how is the process triggered?

In Dubai, the Dubai Department of Economy & Tourism (DET) issues trade licences. The process starts by choosing your business activity, reserving a trade name, and submitting initial approval.

Can a foreign investor own 100% of a company in Dubai under a trade license?

Yes — especially in Free Zone jurisdictions; on the mainland, foreign ownership rules depend on the activity and recent reforms.

How much does it cost to get a trade license in Dubai?

How long is a trade license valid and how often must it be renewed?

A trade license is typically valid for one year and must be renewed annually to keep business operations lawful.

References

- Dubai Department of Economy & Tourism (DET) – Business Licensing: https://www.dubaidet.gov.ae/en/licences-and-permits/business-licensing Dubai Department of Economy & Tourism+1

- Types of Business Licenses in Dubai – CommitBiz: https://www.commitbiz.com/types-of-business-licenses-in-dubai-uae Commitbiz LLC

- Trade Licence & Free Zone vs Mainland: https://globallawexperts.com/det-formerly-ded-vs-free-zones-which-dubai-licence-fits-your-business/ Global Law Experts

- Business Setup in the UAE – Filings.ae Guide: https://filings.ae/guides/business-setup-in-uae Filings.AE

- Mistakes to Avoid When Setting Up a Business in the UAE – RAKEZ Blog: https://rakez.com/en/Blog/Details/Article/105/8-mistakes-to-avoid-when-setting-up-a-business-in-the-uae RAKEZ

- Trade Licence Overview and Types – StartAnyBusiness: https://www.startanybusiness.in/business-license-in-dubai/ Start Any Business UAE

Disclaimer : This guide provides a general information . Regulations and costs may change time to time based on government rules, so consult the best solution’s professional Business Setup consultants for the latest updates. Refer to the glossary for definitions of key terms which is mentioned in this article. Refer to the glossary for definitions of key terms.