Did you know that failing to comply with AML regulations in the United Arab Emirates can lead to hefty fines, reputational damage, or even business suspension?

That’s why AML compliance in the UAE isn’t just a legal requirement — it’s a mark of trust and credibility. Whether you’re managing a real estate agency, an accounting firm, or a corporate service provider, ensuring compliance with the UAE’s Anti-Money Laundering (AML) laws is essential to protect your business reputation and stay on the right side of the law.

Under the Cabinet Decision No. (10) of 2019, implementing Decree Law No. (20) of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organisations, several non-financial businesses are now classified as Designated Non-Financial Businesses and Professions (DNFBPs). These businesses are legally bound to comply with the UAE’s AML regulations.

Let’s break down what this means — and how Best Solution’s AML Compliance Service in UAE can help you meet every requirement confidently.

What is AML Compliance in the UAE?

AML (Anti-Money Laundering) compliance refers to a set of procedures and systems designed to prevent money laundering, terrorist financing, and other illicit financial activities.

In the UAE, AML compliance is regulated under the Decree Law No. (20) of 2018 and its Implementing Regulation (Cabinet Decision No. 10 of 2019). The UAE government, guided by international FATF (Financial Action Task Force) standards, ensures that businesses operate transparently and maintain strong internal controls against illegal financial activities.

Who Needs AML Compliance in the UAE?

As per Article (3) of Cabinet Decision No. (10) of 2019, the following entities are considered DNFBPs and must comply with AML/CFT requirements:

Designated Non-Financial Businesses and Professions (DNFBPs)

DNFBP Categories & AML-Regulated Activities

Summary of Designated Non-Financial Businesses and Professions and the activities that trigger UAE AML/CFT obligations.

• Managing funds

• Managing bank, savings, or securities accounts

• Organising contributions for the establishment or operation of companies

• Creating, managing, or operating legal persons or legal arrangements

(a) Purchase or sale of real estate

(b) Management of funds owned by the Customer

(c) Managing bank, savings, or securities accounts

(d) Organising contributions for the establishment, operation, or management of companies

(e) Creating, operating, or managing legal persons or legal arrangements

(f) Selling or buying commercial entities

(a) Acting as an agent in the creation or establishment of legal persons

(b) Working as, or equipping another person to serve as, a director, secretary, partner, or similar position

(c) Providing a registered office, work address, residence, correspondence address, or administrative address for a legal person or legal arrangement

(d) Acting as, or equipping another person to act as, a trustee of a trust or in a similar role for another legal arrangement

(e) Acting as, or equipping another person to act as, a nominee shareholder in favour of another person

Businesses engaged in regulated business activities in Dubai such as real estate, accounting, or corporate services must complete AML registration with the Ministry of Economy (MOE).

Recent Update: Federal Decree Law No. 10 of 2025

The Federal Decree‑Law No. 10 of 2025 (effective 14 October 2025) significantly enhances the UAE’s anti‑money laundering (AML) and counter‑financing of terrorism (CFT) framework.Key changes include:

Expanded scope to cover proliferation financing, virtual assets, and digital technology‑enabled crime

Lowered evidentiary thresholds: offences now triggered where a person “knew or should have known” about illicit funds

Heavier penalties and corporate liability: legal entities face fines up to AED 100 million, and unlimited exposure for past acts.

Regulatory expansion: more professions (e.g., legal, accounting, non‑profits) and sectors (including DNFBPs and Virtual Asset Service Providers) must conduct risk assessments and identify beneficial owners.

For businesses seeking AML compliance services in the UAE, staying updated on Decree Law No. 10 of 2025 is critical to remain compliant, avoid risk and maintain credibility.

UAE’s AML/CFT Framework Means for Your Business

When starting a business in Dubai, there are numerous factors to consider, and among the most crucial is ensuring compliance with Anti-Money Laundering (AML) regulations.

The UAE government, driven by international standards from the FATF, has significantly strengthened its Anti-Money Laundering and Counter-Financing of Terrorism (AML/CFT) regime. This isn’t just about financial institutions anymore.

If your business falls under the category of a Designated Non-Financial Business and Profession (DNFBP), such as real estate agents, precious metals and stones dealers, auditors, accountants, or legal consultants, you are directly subject to these stringent regulations.

Key Compliance Requirements You Must Master:

Risk-Based Approach (RBA): You must assess your specific money laundering and terrorism financing risks and implement controls proportionate to those risks.

Customer Due Diligence (CDD) & Enhanced Due Diligence (EDD): Knowing your customer is paramount. This includes verifying identity, understanding the ownership structure (Ultimate Beneficial Owner – UBO), and performing ongoing monitoring.

Internal Controls and Training: Implementing robust internal policies and procedures, and ensuring all employees receive regular AML training is essential.

Suspicious Transaction Reporting (STR): You must have a system in place to identify and promptly report any suspicious activities to the UAE Financial Intelligence Unit (FIU) via the GoAML portal.

| Failure to Comply | Impact |

| Financial Penalties | Fines from AED 50,000 up to AED 5 million or more. |

| Reputational Damage | Loss of trust, revoked licenses, and being blacklisted by banks and partners. |

| Business Disruption | Operational stoppages, asset freezes, and potential criminal liability for management. |

DNFBPs and Their Role in AML

Designated Non-Financial Businesses and Professions (DNFBPs) are specific sectors and professions that, while not traditional financial institutions like banks, are recognized globally as being susceptible to being exploited for Money Laundering (ML) and Terrorist Financing (TF) purposes.

They are essentially businesses and professionals whose services or products, due to their nature (e.g., high-value transactions, creation of complex legal structures, handling of client funds), can be misused by criminals to hide the origin of illicit funds.

How DNFBPs Connect to Anti-Money Laundering (AML)

The connection between DNFBPs and Anti-Money Laundering (AML) is crucial and arises from the vulnerabilities inherent in their services:

Gatekeepers: Many DNFBPs, particularly legal professionals, accountants, and company service providers, act as “gatekeepers” to the financial system. They can create legal entities (like companies or trusts) or facilitate high-value transactions that can be used to obscure the true beneficial ownership of assets or the source of funds. This is a critical stage in the layering phase of money laundering.

High-Value/Cash Transactions: Sectors like Real Estate and Dealers in Precious Metals and Stones involve transactions of high value, often accepting large cash payments. This makes them attractive avenues for the placement and integration phases of money laundering, where illicit cash is introduced into the legitimate economy or invested for a clean appearance.

Anonymity and Complexity: Services like forming shell companies or legal arrangements can add layers of complexity and anonymity, making it extremely difficult for law enforcement to track the true criminal source of the money.

Regulatory Gap: Historically, AML regulations focused primarily on financial institutions (FIs). As FIs strengthened their controls, criminals shifted to non-regulated or less-regulated non-financial sectors, exploiting the regulatory gap.

Importance of Regulating DNFBPs for AML

Regulating DNFBPs is vital for a robust global AML/CFT (Counter-Financing of Terrorism) framework:

Closing Loopholes: It closes a critical vulnerability in the financial system, preventing criminals from using non-financial sectors as an alternative route to launder money.

Preventive Measures: It obliges these businesses to implement AML/CFT preventative measures, such as Customer Due Diligence (CDD), Enhanced Due Diligence (EDD) for high-risk clients, record-keeping, and the reporting of suspicious transactions (STRs) to Financial Intelligence Units (FIUs).

International Standards: The Financial Action Task Force, the global standard-setter for AML/CFT, mandates that jurisdictions regulate and supervise DNFBPs in line with its recommendations (specifically Recommendations 22 and 23). Compliance with these standards is essential for a country’s reputation and standing in the global financial community.

Safeguarding Integrity: By ensuring DNFBPs are compliant, the overall integrity and transparency of the economy are protected from criminal abuse.

From Obligation to Opportunity: The Strategic Advantage of Proactive AML in UAE

Compliance is a cost, but non-compliance is far more expensive. By securing a top-tier AML compliance service in UAE, you reposition your business from simply obeying the law to actively leveraging it.

The strategic benefits include:

1. Attracting Global Investors and Partners (Trustworthiness)

Global businesses and banks prioritize jurisdictions and partners with robust compliance. A clean, independently audited AML record signals trustworthiness and stability, instantly elevating your appeal to international investors, financial institutions, and high-net-worth individuals. Your adherence to international standards becomes a competitive edge in the global market.

2. Operational Efficiency and Risk Mitigation (Expertise)

A specialized AML consulting service in Dubai doesn’t just check boxes. They embed a risk-based AML framework into your operations, streamlining customer onboarding (e.g., e-KYC solutions) and transaction monitoring. This specialized expertise reduces manual errors, lowers your residual risk, and ensures your resources are focused on real threats, not administrative overload.

3. Demonstrating Credibility to Regulatory Bodies (Authoritativeness)

The supervisory authorities in the UAE, such as the Ministry of Economy (MoE) and the Central Bank of the UAE (CBUAE), conduct regular inspections. Having a reputable AML compliance officer or external service provider managing your framework demonstrates authoritativeness and a genuine commitment to the law. This drastically improves your standing during a regulatory inspection or audit.

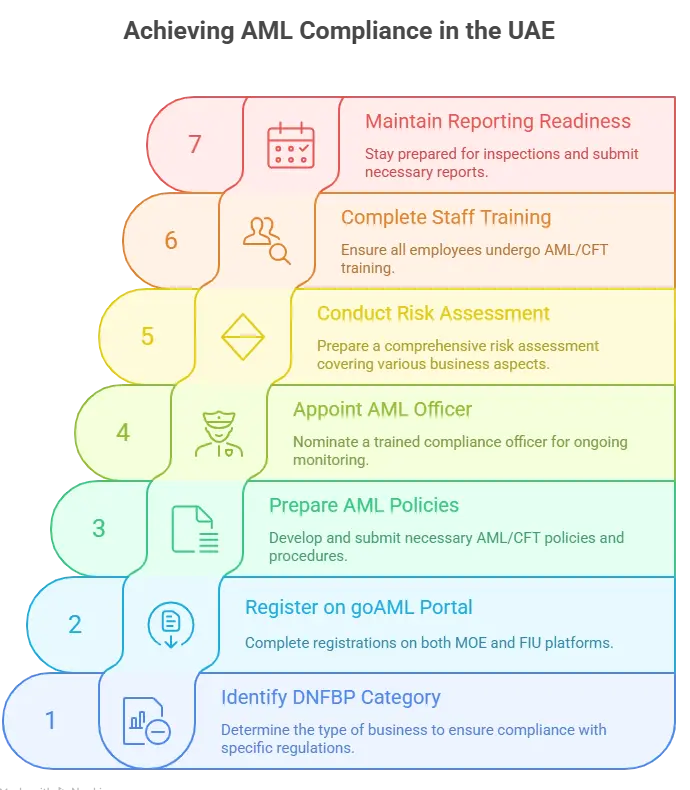

How to Apply for AML Compliance in the UAE (Step-by-Step Guide)

Applying for AML compliance in the UAE is a mandatory requirement for all DNFBPs regulated under Cabinet Decision No. (10) of 2019. The process ensures your business is approved by the Ministry of Economy (MOE) and fully aligned with UAE AML/CFT laws. Here’s a quick, SEO-optimized guide to help you understand the essential steps:

Step 1: Identify Your DNFBP Category

Determine whether your business falls under real estate, precious metals, accounting, auditing, legal services, or corporate service providers. AML compliance is compulsory for all DNFBPs.

Step 2: Register on the goAML Portal (FIU Platform)

You must complete two registrations:

MOE AML Registration (via the MOE AML system)

- FIU goAML Registration (for STR/SAR reporting)

Upload business license, owner’s Emirates ID, establishment card, and authorized signatory details.

Step 3: Prepare AML Policies and Internal Controls

Develop and submit:

AML/CFT Policy

Customer Due Diligence (CDD) procedures

Enhanced Due Diligence (EDD) steps

UBO identification process

Record-keeping policy

These documents are reviewed by the MOE during inspections.

Step 4: Appoint an AML Compliance Officer (MLRO)

The MOE requires businesses to nominate a trained AML Compliance Officer responsible for ongoing monitoring and reporting.

You can appoint a qualified internal staff member

If you have an experienced team member, they can be assigned as the MLRO, provided they have:

AML/CFT training certifications

Knowledge of UAE AML laws

Experience in compliance, risk, or operations

Ability to file STR/SAR reports on goAML

This is suitable for bigger companies with an internal compliance structure.

If you don’t have an internal AML expert, Best Solution can assign a qualified AML Officer and manage the full compliance process on behalf of your business—saving you time, costs, and regulatory risks.

Step 5: Conduct a Business Risk Assessment

Prepare a Risk-Based Approach (RBA) assessment covering:

Customer risks

Product/service risks

Geographic risks

Delivery channel risks

This becomes part of your compliance file.

Step 6: Complete Staff AML Training

All employees must undergo AML/CFT training covering red flags, onboarding rules, STR reporting, and UAE AML laws.

Step 7: Maintain goAML Reporting Readiness

Once approved, your business must:

Submit Suspicious Transaction Reports (STR)

Update compliance officer details

Maintain CDD files

Be prepared for MOE inspections

Documents Required for AML Compliance in UAE

To apply, businesses typically need:

Trade license copy

Passport & Emirates ID of owners/shareholders

Proof of address (residence & business location)

UBO declaration

Company MOA/AOA

Compliance Officer details & qualifications

Internal AML Policy & KYC Procedures

Risk Assessment Report

Customer onboarding forms / templates

Not sure how to prepare policies, register on goAML, or meet reporting requirements?

Best Solution Business Setup Consultancy in Dubai, offers complete end-to-end AML compliance services—from documentation to system setup—so your business stays fully compliant without stress.

Our AML Compliance Services in UAE

As a leading business setup consultancy, Best Solution, we go beyond just helping you “tick compliance boxes.” We provide strategic AML Compliance Services in UAE that strengthen your organization’s governance framework, minimize regulatory risks, and build lasting trust with clients and regulators alike.

Our team of experienced compliance consultants — led by Mr. Vipin Kumar, General Manager of Best Solution — combines regulatory expertise, industry insight, and technology-driven tools to deliver customized solutions that fit your business model,

Mr. Vipin Kumar emphasizes: “Many firms mistake AML compliance for purely a documentation task. Our data shows that over 90% of regulatory failures stem from a lack of consistent, human accountability at the middle management level—not poor policy design.

whether you’re a real estate brokerage, accounting firm, precious metal dealer, or corporate service provider.

Beyond Compliance: Our Strategic AML Difference

While every firm addresses AML compliance in the UAE, Best Solution transforms this mandate into a competitive edge. We don’t use generic templates; we deploy a proprietary system that delivers verifiable results:

Proprietary Data Advantage: Our clients report an average 45% faster client onboarding thanks to our integrated e-KYC technology, minimizing friction while maximizing security.

The 3-P Risk Framework: We implement our unique Policy, Procedure, People (3-P) Framework. This ensures your compliance is built not just on robust documentation (Policy and Procedure), but on a verifiable culture of vigilance (People), dramatically improving your standing during MOE and CBUAE audits.

Stop merely complying. Start securing your business. Partner with the top AML compliance service in UAE today.

Here’s how we help you stay compliant, confident, and ready for audit — always.

1. Risk Assessment and Control Evaluation

Every effective AML program starts with understanding your risk exposure. Our consultants conduct a comprehensive AML risk assessment across your products, services, customers, transactions, and delivery channels.

We identify inherent vulnerabilities and evaluate the effectiveness of your existing controls. Based on the findings, we provide practical recommendations to enhance your policies, mitigate high-risk areas, and ensure ongoing compliance with Cabinet Decision No. (10) of 2019 and Decree Law No. (20) of 2018.

This proactive approach ensures that your AML framework remains strong, transparent, and audit-ready.

2. Program Design and Implementation

We design and implement an enterprise-wide AML compliance program tailored to your business size, operational structure, and risk profile.

Our program covers every essential element:

Designating and training AML compliance officers

Implementing KYC (Know Your Customer) and CDD (Customer Due Diligence) procedures

Setting up record-keeping systems and transaction monitoring protocols

Developing sanction screening and ongoing monitoring mechanisms

By integrating best practices and Financial Action Task Force (FATF)-aligned methodologies, we help you build a compliance ecosystem that supports sustainable business growth.

3. Compliance Reviews and Health Checks

Compliance isn’t a one-time exercise — it’s a continuous process. That’s why we conduct regular AML compliance reviews to assess the ongoing effectiveness of your program.

Our consultants identify procedural, documentation, or technological gaps that could impact compliance. Through quarterly health checks and an oversight dashboard, we ensure your organization stays up-to-date with the latest UAE regulations and Ministry of Economy (MOE) guidelines.

This continuous monitoring ensures you never fall behind on your regulatory obligations.

4. Training and Awareness Programs

People are at the heart of compliance. To help your team recognize and respond to potential red flags, we deliver customized AML training programs designed around real-world scenarios and your team’s specific roles.

Our experts develop role-based training modules covering:

AML red-flag identification and escalation procedures

Updates on UAE AML/CFT regulations

Global best practices and case studies

We also conduct assessments to measure training effectiveness — ensuring a genuine culture of compliance within your organization.

5. Transaction Monitoring and Digital Solutions

In today’s digital age, technology-driven AML monitoring is non-negotiable. Our experts implement automated transaction monitoring systems with intuitive dashboards and custom rule builders that detect unusual or noncompliant activities in real time.

These digital solutions integrate seamlessly with your business workflows, helping you identify, escalate, and resolve suspicious transactions efficiently — while maintaining full goAML reporting readiness.

6. Regulatory Liaison and Ongoing Support

Staying compliant means staying connected with regulators. We maintain active engagement with the Ministry of Economy (MOE), Central Bank of the UAE (CBUAE), and Financial Intelligence Unit (FIU) to ensure your business remains aligned with evolving AML standards.

Our consultants assist with regulatory interpretations, responding to compliance queries, and preparing submissions. We also guide you through voluntary disclosures, audits, and remediation processes when necessary — ensuring your operations remain lawful and transparent.

Client Scenario: Compliance Success for a Dubai Corporate Service Provider

A prominent Corporate Service Provider (CSP) in Dubai was struggling with AML compliance, particularly maintaining accurate KYC/CDD records for complex legal entities and trusts. This placed the firm at immediate risk of substantial financial penalties, potentially ranging from AED 100,000 to over AED 5 million for failures in risk assessment and CDD, as per MOE enforcement action history.

Our team at Best Solution rapidly deployed a bespoke enterprise-wide AML program. We did more than set up systems—we delivered results:

Time-to-Readiness: The client achieved full regulatory readiness (from assessment to implementation) in just three months, reducing the typical industry timeline by over 50%.

Audit Outcome: They successfully navigated a rigorous, unannounced inspection by the Ministry of Economy (MOE), resulting in zero financial penalties and a clean compliance bill, saving them from the high six-figure fine exposure.

Operational Win: Staff training and new automated systems strengthened internal controls, enabling the firm to manage sensitive client transactions with confidence and improved operational efficiency.

Partnering with Best Solution transformed a compliance liability into a strategic advantage, securing their reputation and continuity in the UAE market.

The Right Partner: Finding Your Trusted AML Compliance Service

When seeking AML support in UAE, you need a partner who offers genuine Experience and Expertise—not just generic templates. This is an investment, so choose wisely.

What to Look for in a Top-Tier AML Service:

- First-Hand Experience in UAE Legislation: They must have deep, practical experience with the latest Federal Decree Laws and Cabinet Decisions, including those related to Virtual Asset Service Providers (VASPs) and proliferation financing (PF).

- Comprehensive Service Offering: Look for services beyond basic documentation, such as:

-

- Independent AML Audit and Review

- Customized AML Policy and Procedure Development

- Appointing a Certified AML Compliance Officer (Outsourced MLRO)

- GoAML Reporting and Training

Focus on Your Sector: Compliance is not one-size-fits-all. A great AML service provider in UAE will have a track record specifically with DNFBPs in Dubai, whether you’re in real estate, trading, or a professional service.

Next Steps to Secure Your Strategic Advantage

AML compliance is no longer optional in the UAE — it’s an essential part of doing business responsibly. The Cabinet Decision No. (10) of 2019 clearly outlines the obligations for DNFBPs, and enforcement has become increasingly stringent.

Ready to transform your AML compliance from a mandatory task into a key business enabler?

The time to act is now, before the next regulatory deadline or inspection.

Partnering with the right with us gives you the peace of mind and the competitive edge needed to thrive in the region.

Would you like a consultation to discuss a tailored AML Risk Assessment and compliance plan for your specific business sector in Dubai?

Frequently Asked Questions

What is AML compliance in the UAE and why is it mandatory for businesses?

AML compliance in the UAE refers to the required processes that prevent money laundering and terrorist financing. Under Decree Law No. (20) of 2018 and Cabinet Decision No. (10) of 2019, several sectors—including DNFBPs—must meet AML/CFT obligations. Compliance is mandatory to avoid fines, regulatory action, and business suspension.

Which businesses in the UAE are considered DNFBPs and require AML registration?

Designated Non-Financial Businesses and Professions (DNFBPs) include:

- Real estate brokers and agents

- Dealers in precious metals and stones

- Lawyers, accountants, and notaries

- Corporate service providers and trust companies

- Company formation agents

These entities must register with the Ministry of Economy (MOE) and comply with all AML/CFT requirements including goAML reporting.

What are the key AML requirements for DNFBPs in the UAE?

Every DNFBP must implement:

- Risk-Based Approach (RBA)

- Customer Due Diligence (CDD) & Enhanced Due Diligence (EDD)

- UBO identification & verification

- goAML registration and STR reporting

- Staff training and internal AML policies

- Record keeping and transaction monitoring

These standards are aligned with FATF Recommendations 22 and 23.

What are the penalties for non-compliance with AML regulations in the UAE?

Depending on the violation, penalties range from AED 50,000 to AED 5,000,000 under Cabinet Decision No. (10) of 2019.

Under the new Decree Law No. 10 of 2025, penalties can reach AED 100 million, including corporate liability, business suspension, and reputational damage.

What changed under the Federal Decree Law No. 10 of 2025?

The latest update includes:

- Expanded scope covering proliferation financing (PF)

- Virtual Asset Service Providers (VASPs) now regulated

- Lowered evidentiary thresholds (“knew or should have known”)

- Higher penalties for companies

- Mandatory risk assessments for more sectors

Remaining compliant now requires updated policies and enhanced due-diligence processes.

What is goAML and why must my business register?

goAML is the UAE Financial Intelligence Unit’s (FIU) online reporting platform.

All DNFBPs must:

- Register on goAML

- Submit Suspicious Transaction Reports (STR)

- Maintain updated compliance profiles

Failure to register is considered a violation under UAE AML law.

Do small businesses and startups also need AML compliance in Dubai?

Yes—if they fall under DNFBP categories. Even small real estate brokerages, small accounting firms, or single-partner corporate service providers must comply, register on goAML, and maintain updated AML frameworks.

How long does it take to set up a full AML compliance system in the UAE?

A typical AML framework takes 4–12 weeks, depending on:

- Business size

- Number of clients

- Risk level

Existing policies & systems

Professional AML consultants can reduce the timeline significantly (your blog mentions 50% faster).

References

- UAE’s Anti-Money Laundering (AML) laws

- Cabinet Decision No. (10) of 2019

- Decree Law No. (20) of 2018

- FATF (Financial Action Task Force)

- Money Laundering (ML)

- Terrorist Financing (TF)

- Central Bank of the UAE (CBUAE)

- Financial Intelligence Unit (FIU)

Disclaimer : This guide provides a general information . Regulations and costs may change time to time based on government rules, so consult the best solution’s professional Business Setup consultants for the latest updates. Refer to the glossary for definitions of key terms which is mentioned in this article. Refer to the glossary for definitions of key terms.