Are you an entrepreneur prepared to open a Company in Dubai’s bustling market? Or maybe an investor curious about the UAE’s tax-friendly perks? Understanding the legal types of businesses in the UAE is your first step to making that dream a reality. Dubai, with its prime location and growing economy, is a hotspot for opportunity. But the legal options can seem tricky without the right help.

At Best Solution Business Setup Consultancy, we’ve guided countless entrepreneurs and companies to success in the UAE. In this guide, we’ll walk you through the legal types of businesses in the UAE, focusing on Dubai. Whether you’re launching a startup or growing a global company, you’ll get clear, expert advice to choose the right path.

Who Can open a company in the UAE?

The UAE opens its doors to all kinds of business owners. Local entrepreneurs, international investors, and big companies can all find a place here. A big change came in 2021 when the UAE updated its laws. Now, foreigners can own 100% of most mainland businesses—no need for a local partner to hold 51% anymore. This makes Dubai even more appealing.

Here’s who can jump in

- Entrepreneurs: Solo founders or small teams can pick simple setups like sole proprietorships or free zone companies.

- Investors: Looking for big returns? Try joint ventures or public shareholding companies in fields like tech or real estate.

- Companies: Global firms often choose branch offices or LLCs to expand into the Middle East.

Dubai’s “D33” plan aims to double its economy by 2033, so the timing is perfect. At Best Solution, our team—led by CEO Mr. Essa Al Harthi and General Manager Mr. Vipin Kumar—knows this market inside out. We’re here to help you get started.

What Are the Legal Types of Businesses in the UAE?

The UAE has several legal business types, each fitting different goals. Let’s break down the main options, with a Dubai twist:

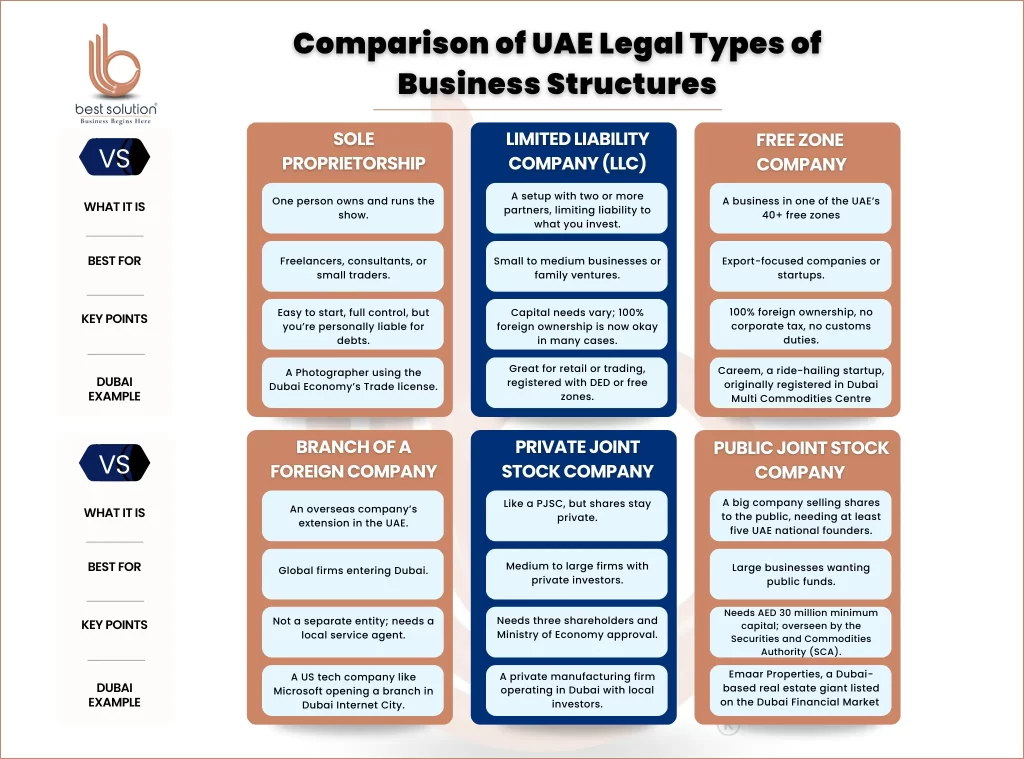

1. Sole Proprietorship

- What It Is: One person owns and runs the show.

- Best For: Freelancers, consultants, or small traders.

- Key Points: Easy to start, full control, but you’re personally liable for debts.

- Dubai Example: A Photographer using the Dubai Economy’s Trade license

2. Limited Liability Company (LLC)

- What It Is: A setup with two or more partners, limiting liability to what you invest.

- Best For: Small to medium businesses or family ventures.

- Key Points: Capital needs vary; 100% foreign ownership is now okay in many cases.

- Dubai Example: Great for retail or trading, registered with Dubai’s Department of Economic Development (DED) or in free zones

3. Public Joint Stock Company (PJSC)

- What It Is: A big company selling shares to the public, needing at least five UAE national founders.

- Best For: Large businesses wanting public funds.

- Key Points: Needs AED 30 million minimum capital; overseen by the Securities and Commodities Authority (SCA).

- Dubai Example: Emaar Properties, a Dubai-based real estate giant listed on the Dubai Financial Market (DFM).

4. Private Joint Stock Company (PrJSC)

- What It Is: Like a PJSC, but shares stay private.

- Best For: Medium to large firms with private investors.

- Key Points: Needs three shareholders and Ministry of Economy approval.

- Dubai Example:A private manufacturing firm operating in Dubai with local investors.

5. Branch of a Foreign Company

- What It Is: An overseas company’s extension in the UAE.

- Best For: Global firms entering Dubai.

- Key Points: Not a separate entity; needs a local service agent.

- Dubai Example: A US tech company like Microsoft opening a branch in Dubai Internet City.

6. Free Zone Company

- What It Is: A business in one of the UAE’s 40+ free zones, like Jebel Ali Free Zone (JAFZA), Ras al Khaimah Freezone (RAKEZ), Meydan Free Zone or Dubai Multi Commodities Centre (DMCC).

- Best For: Export-focused companies or startups.

- Key Points: 100% foreign ownership, no corporate tax, no customs duties.

- Dubai Example:Careem, a ride-hailing startup, registered in Dubai Multi Commodities Centre

Where Can You Establish Your Business in Dubai?

Mainland for local and international sales with no barriers, mostly suitable for physical space, is mandatory. Free zones offer tax perks and global trade, suitable primarily for online businesses like e-commerce

Where you set up affects your legal options and how you operate. Dubai gives you two main choices:

Mainland

- What’s It About: Operate anywhere in the UAE, under Dubai DED rules.

- Pros: Reach local customers easily, fewer limits on what you can do.

- Dubai Spots: Perfect near Dubai Marina or Sheikh Zayed Road.

Free Zones

- What’s It About: Special zones like Dubai Silicon Oasis or DIFC, built for industries like tech or finance.

- Pros: Tax breaks, full ownership, fast setup

- Dubai Hotspot: DMCC near Jumeirah Lakes Towers is big for traders

When Should You Choose a Specific Legal Structure?

Choose your structure based on your business’s current situation. Generally, most people prefer a liability-free legal structure , but affordability is one of the main key player here:

- Starting Out: Go with a sole proprietorship or free zone company—cheap and simple.

- Growing: Switch to an LLC or PrJSC when you need partners or more cash.

- Big Player: PJSCs or branch offices work for established firms with funding or global reach

Real Story: A tech startup named we helped in 2023 started in Dubai Silicon Oasis as a free zone company. By 2025, we guided them to an LLC for mainland sales, growing their revenue by 40%.

Heads Up: As of April 2025, UAE laws are shifting. Look out for perks for green tech and digital firms under the UAE Net Zero 2050 plan.

Why Does the Legal Type Matter for Your Business?

Your choice shapes your business in big ways:

- Liability: Sole proprietorships put your personal stuff at risk; LLCs and free zones protect it.

- Taxes: Free zones give you 0% corporate tax—great for startups.

- Customers: Mainland LLCs sell locally; free zones focus on exports.

- Rules: Each type follows DED or free zone laws, affecting licenses and renewals

Fun Fact: The UAE Ministry of Economy says over 60% of Dubai’s new businesses in 2024 picked LLCs or free zone setups for their flexibility.

However, in our consulting experience, we assist clients in choosing according to their needs.

How Do You Set Up a Business with Best Solution?

With Best Solution Business Setup Consultancy, it’s easy. Here’s how we do it:

- Chat with Us: Tell us your goals—solo gig or big expansion?

- Pick a Structure: Our experts, like Mr. Vipin Kumar, find the best fit.

- Paperwork: We sort out trade names, MOAs, and Ejari contracts.

- Get Licensed: We secure your license through DED or free zones.

- Keep Going: We handle visas and renewals so you can focus on growth.

Pro Tip: “Start with a clear goal,” says Mr. Essa Al Harthi. “We’ll match your structure to boost your profits.”

Conclusion: Start Your UAE Journey Today

Picking the right legal type of business in the UAE isn’t just paperwork—it’s your launchpad to success in Dubai’s exciting market. Love the flexibility of an LLC? The tax-free vibe of a free zone? Or the power of a PJSC? Best Solution Business Setup Consultancy has your back. With years of know-how and a trusted name, we’ve helped businesses shine in the UAE.

Ready to start? Reach out for a free consultation—let’s make your Dubai story a winner. Got questions? Leave them below—we’re all ears!

Disclaimer : This guide provides a general information. Regulations and costs may change time to time based on government rules, so consult the best solution’s professional Business Setup consultants for the latest updates. Refer to the glossary for definitions of key terms which is mentioned in this article. Refer to the glossary for definitions of key terms. Refer to the glossary for definitions of key terms.