Entrepreneurs and global investors are increasingly drawn to the United Arab Emirates for its pro-business environment and strategic advantages. However, navigating the paperwork involved in business setup in Dubai, UAE can be challenging. Among the essential documents, Certificate of Incorporation (COI) in UAE might sound like just another piece of paper, but it’s the foundational key unlocking your business’s legal existence. It verifies that your business is officially recognized and licensed by the appropriate government body in the UAE, across either Mainland or Free Zone jurisdictions

With decades of experience in business setup consultancy in Dubai, UAE, Best Solution specializes in simplifying the entire paperwork process for aspiring entrepreneurs. Our deep expertise has helped countless businesses launch successfully—without delays or errors—thanks to the UAE’s streamlined, digital-first company formation framework. In this comprehensive guide, we break down everything you need to know about the Certificate of Incorporation in UAE—what it is, why it’s essential, how to obtain it, and how it fits into your overall business setup journey. We’ll also clear up common misconceptions, such as the difference between a Certificate of Incorporation and a Trade License, and explore how the process varies across mainland and free zone jurisdictions.

Ready to make your company formation in UAE hassle-free by partnering with Best Solution?.

What Exactly is a Certificate of Incorporation in the UAE?

Embarking on your UAE business journey begins with understanding the cornerstone legal documents. The Certificate of Incorporation in UAE is arguably one of the most significant.

Certificate of Incorporation known as your company’s Birth Certificate.Think of the Certificate of Incorporation as your company’s official birth certificate. It is a legal document issued by the relevant UAE registration authority (e.g., the Department of Economy and Tourism in Dubai for mainland companies, or a specific Free Zone Authority) confirming that your company has been legally formed and registered according to the UAE’s laws and regulations. This certificate officially recognizes your business as a distinct legal entity, separate from its owners.

It signifies that your company:

- Is legally recognized by UAE authorities.

- Has a unique registration number.

- Is permitted to exist as a corporate body.

This document is fundamental for establishing your company’s legal identity and is a prerequisite for most subsequent business activities.

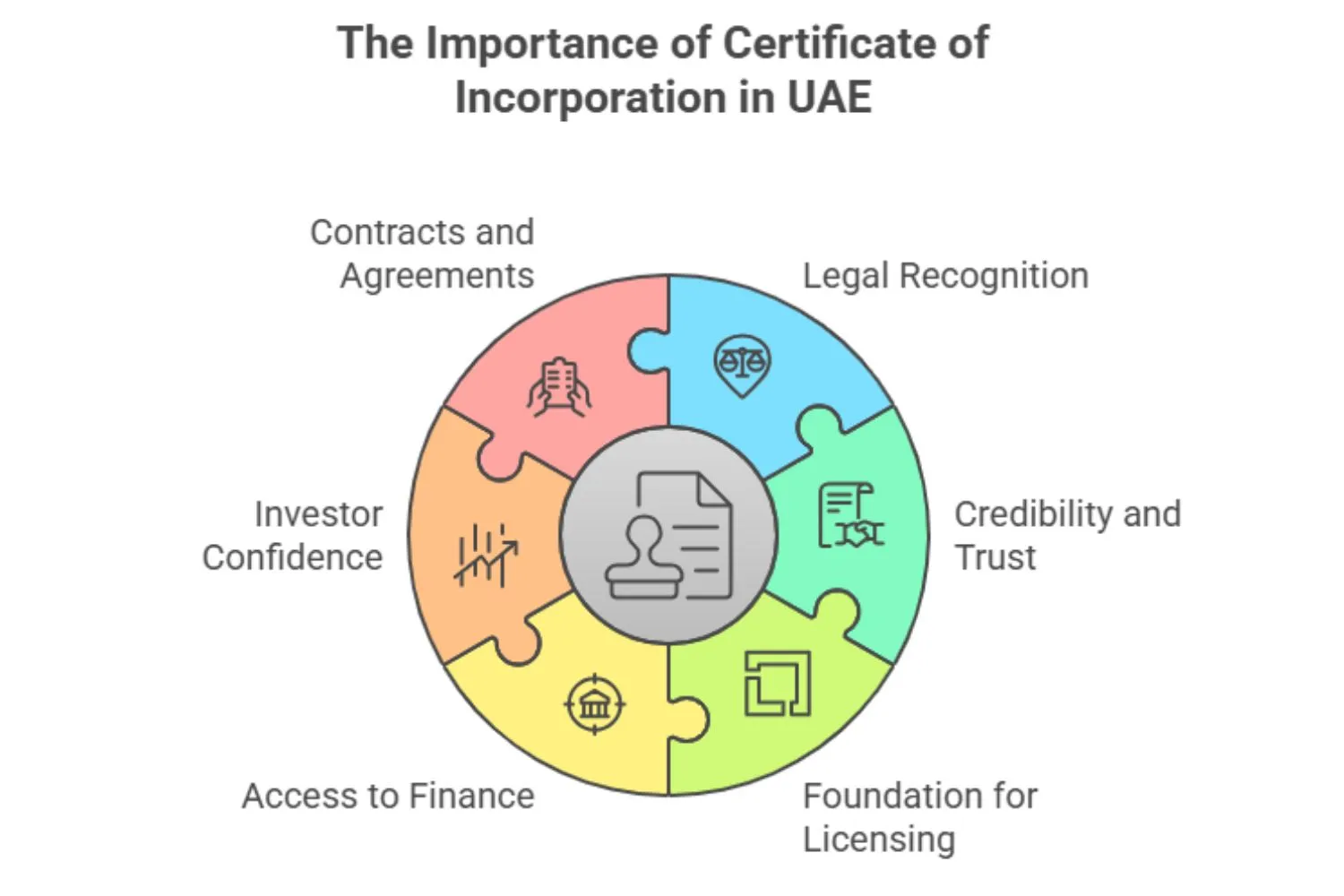

Why is the Certificate of Incorporation Crucial for Your UAE Business?

- Legal Recognition and Standing: It’s irrefutable proof that your company legally exists and can enter into contracts, own assets, sue, and be sued in its own name.

- Credibility and Trust: Possessing a COI enhances your business’s credibility with clients, suppliers, financial institutions, and government bodies. It demonstrates compliance and a serious commitment to operating legally.

- Foundation for Further Licensing: It’s a primary document required to proceed with obtaining your trade license, which authorizes you to conduct specific business activities.

- Access to Finance and Banking: Opening a corporate bank account in the UAE is impossible without a valid Certificate of Incorporation. It’s a key document banks require for due diligence.

- Investor Confidence: For startups and businesses seeking investment, the COI provides assurance to potential investors that the company is properly structured and legally sound.

- Contracts and Agreements: A Certificate of Incorporation is essential when entering into contracts with the government sector and others, suppliers, clients, or partners. It reassures stakeholders of your business’s legal legitimacy and official status.

Without a Certificate of Incorporation in UAE, your business essentially doesn’t exist in the eyes of the law, severely limiting your operational capabilities and exposing you to potential penalties.

A Real-life business challenge Best Solution met and resolved

We recently assisted a Chinese entrepreneur who had been struggling for over three weeks to obtain a Certificate of Incorporation in a prominent UAE free zone. Due to incorrect documentation submitted by a previous consultancy and a lack of and a lack of clarity on legal procedures, his application was repeatedly delayed — putting his investor pitch, office lease, and bank account opening on hold.

When he approached Best Solution, our team immediately conducted a compliance audit, identified the documentation gaps, and liaise directly with the free zone authority to rectify the submission. As an authorized channel partner of the free zone, we leveraged our strong network and deep procedural expertise to fast-track the process. Within just 48 hours, his Certificate of Incorporation was successfully issued.

Because of our experience in business setup consultancy, we not only fast-tracked the incorporation but also guided the client through securing his trade license, opening his corporate bank account, and finalizing his lease agreement — all within the same week.

👉 The Result: A smooth business setup experience, restored investor confidence, and a successful launch — all made possible through the expert guidance of Best Solution.

Key Information Contained in a Certificate of Incorporation

- Full Legal Name of the Company: As approved and registered.

- Company Registration Number: A unique identifier assigned to your business by the regulatory authority.

- Date of Incorporation: The official date the company was legally formed.

- Legal Form of the Company: It specifies the legal structure of the company E.g., Limited Liability Company (LLC), Free Zone Establishment (FZE), Free Zone Company (FZCO), Branch of a Foreign Company, etc.

- Registered Address: The official address of the company in the UAE.

- Jurisdiction: The name of the government department or free zone authority that issued the certificate.

- Share Capital (if applicable): Details about the company’s authorized and paid-up share capital.

- Details of Directors:Names and other pertinent details of the individuals who manage and own the company.

- Names of Shareholders/Partners (sometimes included or in an accompanying document like the MOA): Depending on the jurisdiction and company type.

- Primary Business Activity (often referenced or linked to the license): A general indication of the business scope.

Understanding these elements helps you verify the accuracy of your certificate and ensures you have the correct information for all subsequent legal and financial processes.

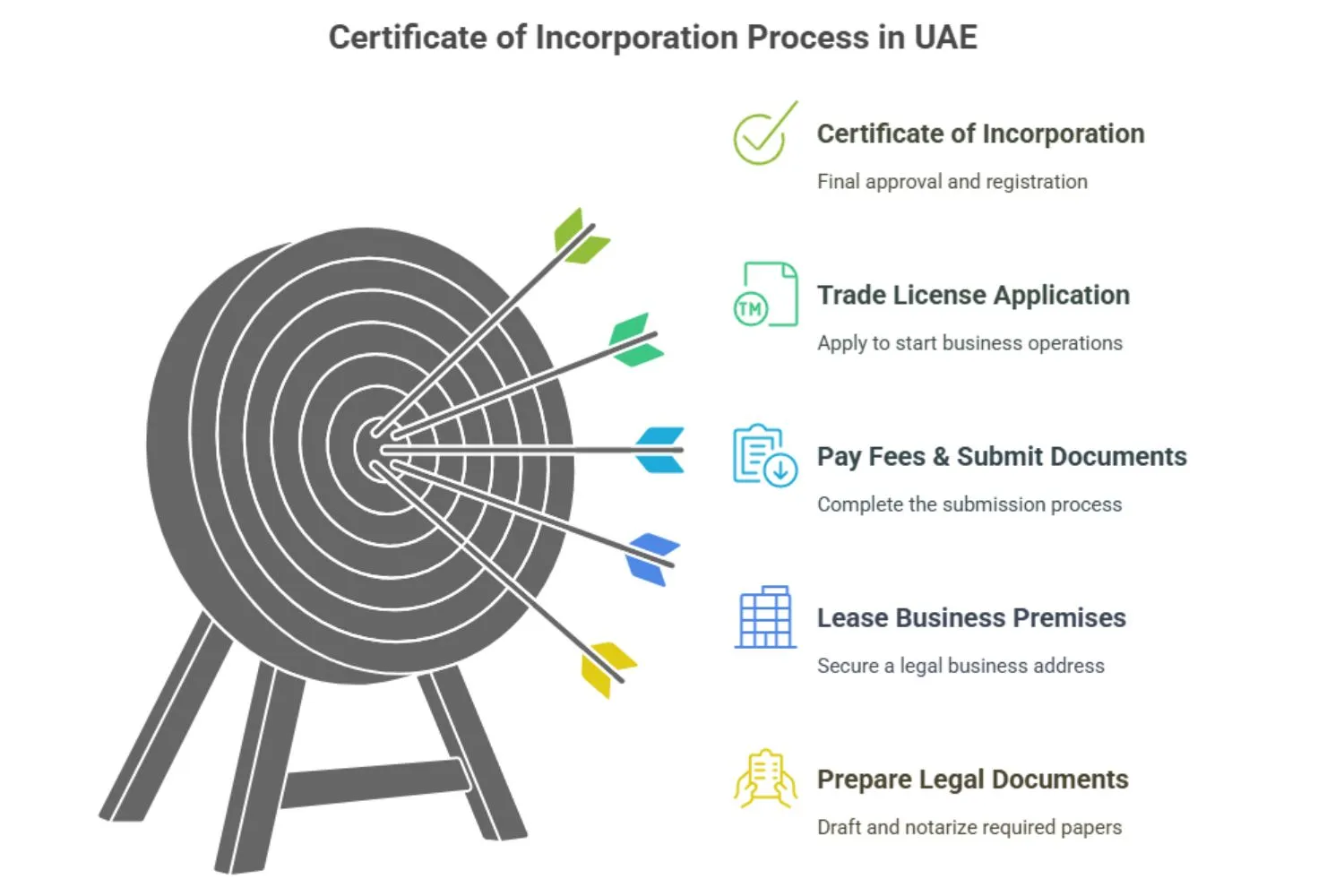

How to Get Certificate of Incorporation in UAE: A Step-by-Step Guide

- Choose Business Jurisdiction: Decide between Mainland, Free Zone, or Offshore setup based on your business goals and activity.

- Select Business Activity: Choose your business activity from the approved list by the relevant authority (e.g., DED or Free Zone authority).

- Reserve Your Trade Name: Apply for a trade name reservation that reflects your brand and complies with UAE naming rules.

- Submit Initial Approval Application: Get initial approval from the concerned authority to proceed with your company formation.

- Prepare Legal Documents: Draft and notarize required documents like the Memorandum of Association (MOA), Articles of Association (AOA) (if applicable), and other incorporation forms.

- Lease a Business Premises: Secure a legal business address and obtain your Ejari (tenancy contract) or flexi-desk lease agreement.

- Submit Final Application: Submit all documents to the licensing authority for final approval and registration.

- Receive the Certificate of Incorporation: Once approved, you’ll be issued the Certificate of Incorporation, confirming your company is legally formed.

- Proceed to Trade License Application: After incorporation, apply for your Trade License to start business operations legally.

- Pay Fees & Submit Final Document: Once you get all approvals, pay the required fees and submit the complete set of documents to the DED or Free Zone authority—this includes your approved forms, legal papers, and payment receipt.

- Get Your Certificate of Incorporation: After processing, you’ll receive your Certificate of Incorporation along with the Trade License—officially confirming your company is now legally registered and ready to operate in the UAE.

The exact list can differ based on the chosen jurisdiction (mainland or specific free zone) and the company’s legal structure.

Timelines for Getting the Certificate of Incorporation (COI) can vary depending on the business jurisdiction. Mainland setups typically take a few days to a couple of weeks, while many free zones offer faster processing, with some delivering licenses in just 2 days—especially when facilitated by Best Solution.

At Best Solution Business Setup Consultancy, we’ve supported hundreds of entrepreneurs in securing their Certificate of Incorporation in UAE quickly, efficiently, and without the usual paperwork struggles. Our clients consistently highlight our speed, transparency, and hands-on support as reasons for choosing us.

Cost of Getting a Certificate of Incorporation in UAE

The cost of obtaining a Certificate of Incorporation in the UAE varies depending on the jurisdiction — whether you’re setting up in the Mainland, a Free Zone, or an Offshore entity. It’s important to note that there is no separate fee for the Certificate of Incorporation itself; it’s included in the overall trade license package. However, the total setup cost differs by zone. To explore the detailed pricing and benefits for each jurisdiction, visit our dedicated pages: Mainland Company Setup, Free Zone Company Setup.

Let Best Solution guide you to the most cost-effective and strategic option for your business goals.

Validity of the Certificate of Incorporation in the UAE

A Certificate of Incorporation in the UAE is permanently valid, provided your company remains legally active and compliant with renewal requirements.

- The Certificate of Incorporation itself does not expire, but your trade license and visas must be renewed annually.

- Authorities may require a fresh COI if your company undergoes changes (like legal name, ownership, or structure).

📌 Fact: The Certificate of Incorporation remains a core document even years after formation — banks, investors, and legal processes regularly request it.

Can Amend the Certificate of Incorporation?

Common Amenable Details:

- Company Name Change

- Legal Structure Update (e.g., from sole proprietorship to LLC)

- Shareholder or Ownership Changes

- Business Activity Adjustments

- Manager or Director Details

How the Amendment Process Works:

- Submit an Official Request to the licensing authority (Free Zone, DED, or Offshore registrar).

- Provide supporting documents, including board resolutions or updated MoA.

- Pay the applicable amendment fee (typically AED 1,000–2,500 depending on the change and authority).

- Receive the updated Certificate of Incorporation and company license reflecting the changes.

📌 Fact: In most UAE free zones, amendments can be completed within 3–7 business days, but Mainland changes may require additional external approvals.

Where can You find out the certificate of incorporation

If your business is Mainland (e.g., Dubai DED, Abu Dhabi ADDED):

You can get your COI or license copy via:

- Dubai:

🔗 https://eservices.dubaided.gov.ae

→ Log in with your account → Go to “My Transactions” or “License Details” → Download trade license/COI. - Abu Dhabi:

🔗 https://www.added.gov.ae

→ Use your UAE Pass or business account to access the portal and download your license.

If your business is in a Free Zone:

Keep in mind that in the Free Zone, Certificate of Incorporation can only be obtained through official channel partners, such as Best Solution, who are authorized to handle submissions and liaise directly with Free Zone authorities.

If Offshore (e.g., RAK ICC, JAFZA Offshore):

You must request it through:

- Your registered agent

- Or via the official portal of the offshore authority (e.g., RAK ICC at https://www.rakicc.com)

Don’t Have Access?

If you used a business setup consultant they likely have a copy or can reissue it for you. Reach out directly to your consultant for support.

Certificate of Incorporation for Mainland vs. Free Zone UAE Companies

Mainland Company Incorporation Certificate

- Issuing Authority: Typically the Department of Economy and Tourism (DET) in the respective Emirate (e.g., Dubai DET).

- Implications: Allows your company to trade directly within the UAE local market and internationally. It may also allow you to bid for government contracts. For certain activities, a local UAE national sponsor or service agent might be required, though recent reforms have expanded 100% foreign ownership for many mainland licenses.

- Process: Generally involves approvals from multiple government entities depending on the business activity.

Free Zone Company Incorporation Certificate

- Issuing Authority: The specific Free Zone Authority where your company is registered (e.g., DMCC, JAFZA, DIFC, Dubai South, etc.). Each free zone has its own rules and regulations.

- Implications: Offers benefits like 100% foreign ownership, 0% corporate and personal income taxes (subject to conditions and potential future changes like corporate tax), and customs duty exemptions for import/export.

- Process: Often more streamlined and faster within the free zone’s ecosystem. Documentation requirements can be specific to the chosen free zone.

Key Differences in Process and Documentation

While the core concept of the Certificate of Incorporation in UAE remains the same, key differences include:

- Governing Body: DET for mainland vs. individual Free Zone Authorities.

- Capital Requirements: Some free zones have minimum share capital requirements, while mainland requirements can vary.

- Office Space: Mainland companies typically require a physical office space evidenced by an Ejari. Free zones offer flexible office solutions, including flexi-desks.

- External Approvals: Mainland setups may need more external ministry approvals depending on the activity.

Choosing between mainland and free zone is a critical decision. Best Solution provides expert customized solutions to help you determine the optimal jurisdiction for your business needs. Learn more about our PRO services in Dubai which can assist with government liaison for both setups.

What is the Difference Between Certificate of Incorporation and Trade License in UAE

A common point of confusion for new entrepreneurs in the UAE is the difference between a Certificate of Incorporation and a Trade License. While both are essential, they serve distinct purposes.

Certificate of Incorporation: Proof of Legal Existence

As established, the Certificate of Incorporation in UAE is the document that legally brings your company into existence.

It confirms: Your company is a registered legal entity.

It establishes: Your company’s identity, registration number, and date of formation.

It is generally: A one-time issuance document that doesn’t typically require renewal (though amendments might be needed for major company changes).

Trade License: Permission to Operate and Conduct Activities

The Trade License, on the other hand, is an operational permit.- It authorises: Your legally incorporated company to conduct specific business activities listed on the license.

- It is issued by: The relevant economic department (for mainland) or free zone authority after the company is incorporated.

- It specifies: The commercial, industrial, professional, or tourism activities your business is permitted to undertake.

- It requires: Annual renewal to remain valid.

Think of it as your company’s driver’s license, allowing it to “drive” or operate within specific categories.

Do You Need Both? A Clear Answer—Backed by Experience

Yes, absolutely. You cannot legally operate a business in the UAE with just one of these documents. Both the Certificate of Incorporation and the Trade License are essential—and serve distinct purposes.

At Best Solution, we’ve assisted many clients who believed that securing just one document — either the Certificate of Incorporation or the Trade License — was enough to start operations. One such case was a French tech entrepreneur who reached out to us through a BNI referral via Mr. Vipin Kumar, our General Manager. He had already obtained his Certificate of Incorporation, which legally established his company, but lacked a Trade License, which is essential to operate in the UAE. Without it, he couldn’t open a bank account, sign contracts, or legally conduct business. His company existed on paper but remained non-functional — highlighting the critical difference between incorporation and licensing.

With our expertise, we quickly identified the gap, helped restructure his application, and secured the appropriate license aligned with his business activity—all within days.

Here’s how it works:

First, your company obtains the Certificate of Incorporation (and often the Memorandum of Association) to establish itself as a legal entity in the UAE.

Then, based on that incorporation, you apply for and receive a Trade License, which authorizes your business operations in your chosen activity or sector.

With our years of hands-on experience in Dubai’s regulatory landscape, Best Solution ensures that no step is missed—saving you time, avoiding costly delays, and setting you up for long-term success.

Conclusion: Your First Legal Step to Business in UAE with Best Solution

The Certificate of Incorporation in UAE is not just a document; it’s the official proclamation of your business’s legal birth in one of the world’s most dynamic economic hubs. It lays the groundwork for all subsequent operational, financial, and legal activities, from opening your bank account to obtaining your trade license and scaling your venture.

Understanding its significance, the process to obtain it, and how it differs yet complements your trade license is crucial for any aspiring entrepreneur or investor in the UAE.

While the path may seem complex, it doesn’t have to be a journey you undertake alone. At Best Solution Business Setup Consultancy, we simplify every step with a blend of unmatched expertise and client-focused service:

- Unmatched Expertise: Guided by industry leaders like Mr. Essa Al Harthi, our team understands every nuance of UAE business laws across mainland and free zones.

- Client-Centric Approach: Your goals come first — we provide tailored solutions to match your business model.

- Transparent Pricing: No hidden fees. We operate on a fixed pricing model with full cost clarity from the start.

- Fast & Efficient Service: From 2-day license processing (where applicable) to end-to-end support, we get you operational quickly.

- Dedicated Support: You’ll have a dedicated consultant from your first call to post-setup assistance.

- Robust Network Access: We connect you with banks, real estate agents, and business partners to support your growth.

- Proven Success: Proven Success: With 200+ successful company formations, our results speak for themselves. This is further reflected in our glowing reviews on Google Business Profile, showcasing client satisfaction and trust. As Vipin Kumar, our Operations Head, puts it: “Our client’s success is the true measure of our own.”

Ready to take the first definitive step towards launching your UAE business? Don’t let paperwork and procedures hold you back. The experts at Best Solution are here to simplify the entire process of obtaining your Certificate of Incorporation in UAE and guide you through every stage of your company formation.

Contact Best Solution business consultancy in Dubai, UAE today for a free, no-obligation consultation. Let us handle the complexities, so you can focus on what you do best – building your business. Experience our commitment to transparency, efficiency, and dedicated support firsthand.

Frequently Asked Questions

Do UAE companies have certificates of incorporation?

Yes. Without a Certificate of Incorporation, a UAE company is not legally recognized and cannot operate or conduct business

Can I get a digital copy of my Certificate of Incorporation?

Yes, most UAE authorities issue digital (PDF) copies of the Certificate of Incorporation, which are considered official. It’s always advisable to keep secure digital and physical copies.

What happens if I lose my Certificate of Incorporation?

You can apply for a certified copy from the issuing authority (DET or the relevant Free Zone Authority). There might be a nominal fee for reissuance.

Is a Certificate of Incorporation the same as a commercial license?

No, a Certificate of Incorporation is not the same as a commercial license. It proves your company is legally registered in the UAE, while a commercial license allows your business to operate and conduct specific commercial activities.

Disclaimer : This guide provides a general information . Regulations and costs may change time to time based on government rules, so consult the best solution’s professional Business Setup consultants for the latest updates. Refer to the glossary for definitions of key terms which is mentioned in this article. Refer to the glossary for definitions of key terms. Refer to the glossary for definitions of key terms.